Intro

The secret to buying like a billionaire

Token types

Can tokens bring in the big bucks?

Growth of cryptocurrency tokens

Why should you care?

Tokenization possibilities

How tokenization is disrupting ownership of everything

How tokenization transforms the business landscape

In 2021, Italian museums tried to recoup losses caused by the pandemic. It was also a matter of concern for legendary Uffizi Galleries, a museum in the heart of Florence, which housed some of the world’s most famous artworks. Amid lockdowns that followed one another, the number of annual visitors fell from 4.4 million to 1.2 million, so the venue desperately needed financing to offset losses incurred during the pandemic.

A museum’s director researched various options when he looked for a new way to generate income. How could they continue to showcase their priceless artworks to the world and generate revenue while visitors were unable to come and see them in person? The solution came in the form of asset tokenization.

The Uffizi Galleries decided to create NFTs (non-fungible tokens) for some of their most famous artworks. The venue offered Michelangelo’s masterpiece Doni Tondo (1505–06) for sale as NFTs. The customer was found soon. A wife of a famous Italian collector wanted to buy its tokenized version as a birthday gift for her husband. The amount of the deal was 170,000 USD.

The story of the Uffizi Galleries’ use of NFTs to sell their masterpieces highlights the potential of asset tokenization for generating revenue in times of crisis. Tokenization opens new opportunities for other industries as well. For example, real estate properties, commodities, and even intellectual property can be tokenized and traded on blockchain-based platforms. The possibilities are endless, and many companies are already exploring this new frontier to create new business models and revenue streams.

Imagine being able to own a piece of a rare painting or luxury hotel, worth millions, without having to break the bank. Sounds too good to be true? With tokenization, this is now a reality. The innovative concept of tokenization has changed the way people think about owning and investing in valuable assets. Investors can now own a piece of something they may have never thought possible before.

Though the Italian customer mentioned above was ready to purchase the NFT of the masterpiece as a single asset, tokenization provides the possibility of selling fractions of the artwork to multiple buyers. This would allow more people to have a stake in the artwork, and potentially generate even more revenue for the museum. It’s one of the benefits of tokenization – the ability to divide an asset into smaller parts that can be bought and sold individually. This opens up new possibilities for investment and ownership, and could have a transformative effect on business. It means that more people can have a stake in the asset, even if they don’t have the resources to buy it outright. In the following section, we will explore the basics of tokenization, when real world assets are converted into digital tokens. It all actually starts with a token, which is sold to customers. But what exactly is a token?

Token is a buzz word nowadays. With the arrival of blockchain, the concept of tokens extended to digital format. In the past, commodity money such as shells, grain, tobacco, shark teeth, and other items were used as a means of payment. Today, people can use cryptocurrency tokens to purchase goods and services.

The term “token” was originally used to describe objects that replaced money, and it continues to be used in various contexts today. Examples of tokens in daily life include subway tokens or casino chips, which serve as tokens representing money in the gambling venue.

Token is a proof of asset ownership, which can include cryptocurrency. Tokens represent digitized ownership of an asset that can be used as a means of payment.

Token is a piece of code that represent ownership of a specific asset, and are issued via smart contracts on a blockchain.payment.

However, in the world of blockchain, tokens take on a more complex meaning. They are essentially pieces of code that represent ownership of a specific asset, and are issued via smart contracts on a blockchain. You can find more details how users access services and data in decentralized networks in our in-depth review of the web3 technical landscape. In general, token is a broad term, which is used to describe different groups of digital assets. There is no official classification of tokens, so we came up with our own version of how tokens can be classified by purpose of use. It can help you understand the subject better. You should also remember that the content presented below is based on materials from publicly available sources and provided for informational purposes only, hence should not be construed as investment advice.

As the name suggests, these assets are designed to pay for utilities on the blockchain, providing benefits and granting exclusive access to some services within the ecosystem where the token is issued. Used to access a particular product or service, they are not intended to work as a means of payment or investments though they are still used this way when they become speculative and highly valued. These are cryptocurrencies that enable specific actions in an application, for instance, Binance Coin (BNB), which has several utilities within the Binance ecosystem, and Filecoin (FIL), which is used to pay for storage space on the Filecoin network.

It is also worth saying about DeFi apps that need such assets to fuel their systems since they help to provide liquidity and process transactions. Sometimes utility tokens are additionally used as governance tokens, which occurs in the projects with dual structure, for instance, the MakerDAO token (MKR), which serve both as a governance token and a utility token.

As the term implies, these tokens are native cryptocurrencies, which are used for processing transactions and their rewards. This is a type of digital token that is designed to facilitate transactions on a particular blockchain platform. These tokens are typically used to pay for fees associated with using the blockchain network, such as transaction fees and gas fees. They may also be used as a means of exchange for goods and services within the platform’s ecosystem.

The example of a transactional token is XRP (Ripple). XRP is a cryptocurrency that is designed to facilitate fast and secure cross-border payments with low fees. Its main utility is to act as a bridge currency for different fiat currencies and facilitate transactions between them on the Ripple network. XRP is used to pay for transaction fees and can also be used as a means of payment for goods and services, making it a transactional token.

These are cryptocurrencies designed specifically for use as a medium of exchange. These tokens can be used to pay for goods and services, both within and outside of a particular blockchain platform. Examples include Bitcoin (BTC), Litecoin (LTC), and Bitcoin Cash (BCH).

These tokens are backed by a tangible or intangible asset, such as gold or real estate. They can be used as a store of value or as a way to access a specific asset. Examples include Tether (USDT), which is backed by the US dollar, and Paxos Standard (PAX), which is backed by a combination of US dollars and short-term US Treasury bills.

With development of DeFi, the decision making processes become critical, so governance tokens present the solution to manage such issues. These tokens are used to govern a specific blockchain network or protocol. They allow token holders to vote on proposals, make decisions, and participate in the governance of the network. Examples include MakerDAO (MKR), a blockchain platform, aimed to solve volatility issues for the cryptocurrency market, which allows holders to vote on proposals related to the stability of the Dai stablecoin, and Uniswap (UNI), a popular decentralized crypto trading protocol, which allows holders to vote on changes to the Uniswap protocol, though the token has other utilities as well. It is used to attract liquidity and pay transaction fees when swapping tokens on the Uniswap platform.

These tokens are unique and non-interchangeable, and are used to represent ownership of a specific digital asset, such as artwork, music, or in-game items. Each NFT is unique and has its own distinct value. Such assets are often sold at auction. Examples include CryptoKitties, NFTs of unique digital cats, NBA Top Shot, NBA-themed digital collectibles, and Beeple’s digital artwork, a square collage of 5000 artworks created by the American artist, which was sold for $69 million at auction in March 2021.

These are tokens that represent ownership in a real-world asset. In other worlds, these assets are a digital form of traditional investments, such as stocks, bonds, or real estate. Unlike utility tokens or payment tokens, security tokens are subject to federal securities laws and regulations in their jurisdictions. These tokens can offer investors additional benefits, such as fractional ownership, increased liquidity, and automated compliance. Examples of security tokens include tZERO (TZROP), a blockchain asset exchange, which addresses the issues of ICOs’ regulatory compliance and SPiCE VC (SPICE), the first liquid venture capital fund with full compliance.

What is important for us here is that these tokens are created through a process called tokenization. So, we will delve deeper into this particular aspect in this article.

For over 8 years, Whatdahack?! has been at the forefront of asset tokenization, helping businesses and individuals unlock the full potential of blockchain technology. Whether you’re looking to digitize physical assets, enhance liquidity, or create entirely new economic models, our expert team provides everything you need to succeed in the decentralized world.

Our services include:Take your business to Web3 with Whatdahack?! tokenization service.

The rewards can add up round-the-clock in the cryptocurrency sector. There are different ways to earn tokens on different platforms. The methods of obtaining tokens are indeed different from acquiring classic shares of companies. For example, in some blockchain networks, users can earn tokens by participating in network activities such as mining or staking. In mining, users contribute computing power to verify transactions and earn tokens as a reward. In staking, users hold a certain amount of tokens and use them to participate in consensus mechanisms that help secure the network. By doing so, they earn rewards in the form of additional tokens.

By participating in staking, network validators help to increase the value and trust in the project, which can result in increased transaction volume, larger transactions, and higher token values. This can create a positive feedback loop where the value of tokens increases with the growth of network popularity.

Users can also participate in bug bounty programs, when they need to detect vulnerabilities and report security flaws in the system of the platform so that the team can fix them. The size of the reward often depends on the severity of the bug and the potential impact it could have on the company’s operations or the security of its users.

Once users earn tokens, they can hold onto them as an investment or use them to access products or services within the platform. The value of a token received from one company or another depends on various factors, such as the popularity and adoption of the platform, the supply and demand for the token, and market conditions. Some tokens may have a fixed value, while others may fluctuate in value based on market forces, thus enabling traders to earn on high volatility of crypto tokens. As you see, there are plenty of ways people use to make bank in the crypto world. But let’s not forget about the security tokens, the reliable money makers of the bunch. These tokens generate returns for investors through a variety of mechanisms, like regular dividends, profit sharing, interest payments, and good old-fashioned appreciation. And sometimes, the token issuer even buys them back from you just as a publicly traded company buys back its stock.

Tokens can increase or decrease in value, just like company shares, state bonds, or other assets. However, the growth in the token market comes with higher risks due to its relatively new and unregulated nature. While certain tokens may grow in value, there is no guarantee, and investors should be aware that they could also lose their investment. As regulation is introduced in different countries, it is uncertain how many tokens in circulation may be at risk of default or become subject to stricter compliance requirements. This uncertainty highlights the importance of conducting thorough research and due diligence before making decisions in a crowded market of tokens.

When we tokenize an asset, either a digital asset or physical as the painting described above, it is presented as digital tokens on a blockchain. The value of each token is backed by the underlying asset, so the price is determined by supply and demand in the market.

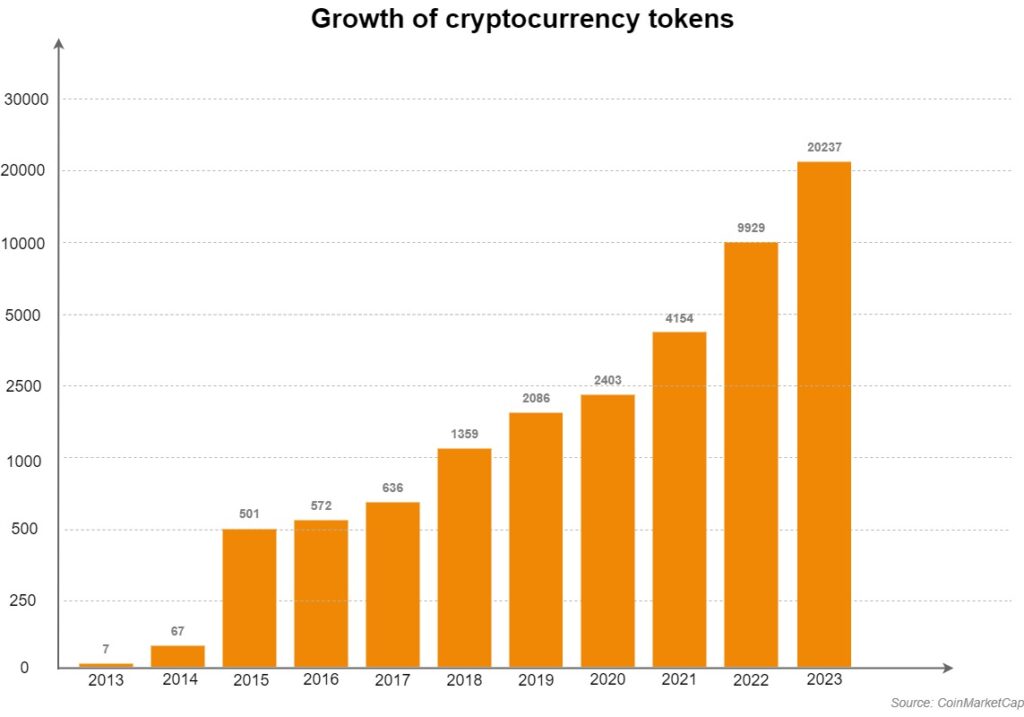

After Bitcoin made its grand entrance in 2009 and Ethereum joined the party in 2015, the world of crypto has exploded! It is worth saying that tokenization has played a crucial role in this growth. It made it easier for businesses to create their own tokens, leading to an influx of new tokens entering the market. As a result, the number of crypto coins and tokens has been growing like a weed.

The number of cryptocurrencies has grown exponentially over the past decade. In 2013, there were more than 50 different cryptocurrencies, and by the end of the following year, this number had increased by almost ten times to over 500. In 2021, the number of crypto tokens reached 9K, but then it doubled in 2023 and reached almost 20K tokens. Though discounting “dead’ cryptos leaves us with 9K tokens, it still seems too much to make a choice! So, the question is: can there be too many cryptocurrencies?

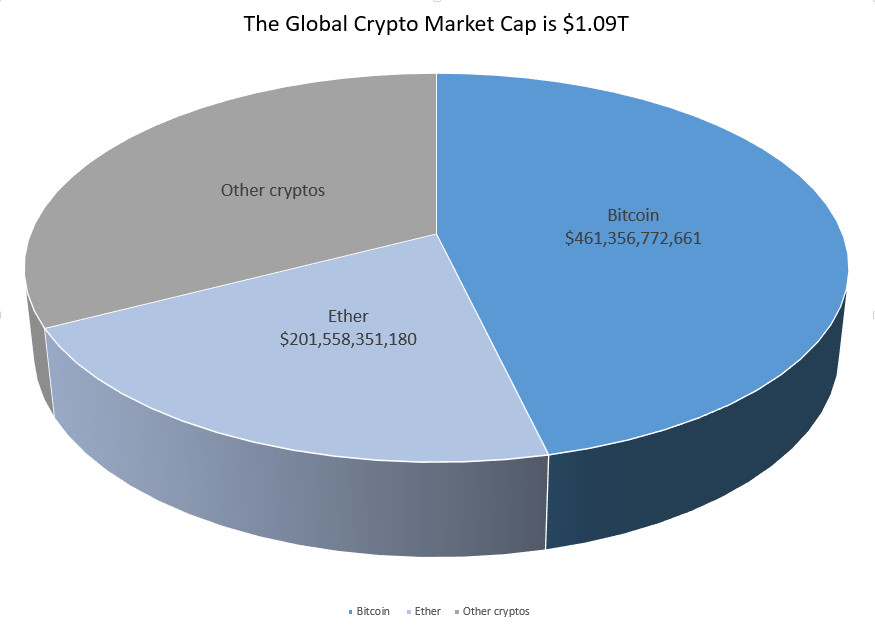

Various tokens are created by different platforms in the blink of an eye. The market is flooded with memecoins, which are cryptocurrencies created for the purpose of humor or satire, like Dogecoin. However, this proliferation doesn’t remove the dominance of Ether and Bitcoin, which take the lion share of the whole cryptocurrency market. According to the data of Coinmarketcap at the time of writing, together these coins take almost 60% of the market, while other tokens have fierce competition.

As newer cryptocurrency tokens arise, the fragmentation of the industry increases leading to more dead coins, the term that was coined for tokens or coins, which are not in use any longer, therefore are delisted from exchanges.

Higher fragmentation of the market contributes to it since coins should have enough liquidity for a healthy ecosystem.Low liquidity has a negative impact on the system, and, ultimately, kills the token, which is in low demand.

As the token market continues to expand, the number of services and companies aimed at evaluating project reliability and market appeal also grows. Investors mainly use tools for tracking token data, exploring various aspects of the token and its underlying project, such as the token’s price history, market capitalization, trading volume, circulating supply, total supply, the project’s roadmap and whitepaper. They can also monitor the token’s performance on different exchanges, check the project’s social media and community activity, and assess notable partnerships or collaborations established by the project. Additionally, investors can use technical analysis tools to analyze charts and trends to make conscious decisions when buying or selling the token.

Despite tools available for tracking token data, making informed decisions requires a more comprehensive approach. This includes knowledge of technology, macroeconomics, statistics, and psychology, among other fields, to meet market demands. Not an easy task, yeah? It can be challenging for non-savvy users to perform due diligence on the tokens to invest in. These should be credible projects that add value to the ecosystem, so it is necessary to study documentation and technical details to understand if the project is worthy.

Since we touched upon different aspects of tokens, the concept of tokenization should be clear to you. Tokens are a key component in the process of tokenization, which involves converting physical assets into digital tokens that can be traded on a blockchain network. These tokens represent ownership rights to the underlying assets, and investors can use them to buy, sell, or trade their stake in the asset. It opens a brilliant opportunity to trade real world assets on the blockchain, and improve their liquidity that refers to the ease to convert assets into cash.

Tokens are a key component in the process of tokenization, which involves converting physical assets into digital tokens that can be traded on a blockchain network.

Here is an example that helps to describe the concept in a simple way. Each token is like a LEGO block that represents a specific piece of value, such as a share of a company or a unit of real estate. Tokenization is the process of breaking down these assets into smaller, more manageable pieces, just like how a LEGO set comes with many different pieces that can be combined in various ways to build something bigger.

With tokenization, these individual “blocks” can be easily traded, bought, or sold, just like how LEGO blocks can be combined, separated, and used to build different structures. And just as LEGO blocks come in many different shapes and colors, tokens can represent a wide range of assets, from traditional stocks and bonds to alternative assets like real estate and art.

Overall, just like how LEGO blocks have revolutionized the toy industry by allowing endless possibilities for creativity and innovation, tokenization is revolutionizing the investment industry by providing new opportunities for access, liquidity, and flexibility in investing.

So, why should you care about tokenization? Well, do you like money? Tokenization works like magic turning physical assets into digital tokens that can, probably, make you rich. You can turn anything into a valuable asset and sell it. If you are still skeptical about the potential of this technology, let me remind you how hard it is to adapt to changes. But those who do it, can become prosperous.

There was a time when people wore handmade clothing and it was the norm then. It took countless hours for skillful artisans to create exceptional, gorgeous garments, which were crafted with care. As technology evolved, people started using machines for that. So, it doesn’t take that long to produce clothing now. It is also made at a fraction of the cost, which people used to spend on garment before.

Initially, people didn’t believe it would happen. They considered that clothing made by machine is of low quality and it’ll never replace handmade beautiful garments. They were skeptical about it. So, what do we have now? Do you wear handmade clothes? Do you know anybody who does? Thus, the invention of machines created a different reality and changed the world. With time, people adopted new technology and discovered its benefits. They highly appreciated fast production and low prices. In this way, artisans faced serious competition and ultimately lost in that race. Machine-made clothing has finally replaced a more elaborate production, which is a rarity nowadays.

Now the tech world brought other instruments to us. Blockchain-based technologies can make many processes cheaper and faster, but it takes time for people to adapt. Those who do it faster, can win and take the leading position in the market.

You might want to know what exactly can be tokenized. Tokenization is a powerful tool that can be used in just about any industry. The possibilities are almost endless. With tokenization, you can represent anything from real estate to artwork to loyalty points as tokens. Let us look at the opinion of a famous, reputable crypto investor on the subject:

“All the leakage you have today goes away in a world of DeFi because you will financialize every single asset possible. You’ll financialize your homes. You’ll financialize your cars. You’ll financialize your watches, your jewelry, your art. You’ll financialize every random thing including your career.”

Billionaire venture capitalist Chamath Palihapitiya predicted tokenization of all assets in the world driven by the cryptocurrency industry.

Tokenization is a fascinating technique that has numerous applications in the world of business. Companies can create tokens that represent specific projects and assign them a certain value. This makes them super useful for financing new initiatives and automating company processes related to the ownership and transfer of assets. For example, tokenization allows for the creation of smart contracts that can automatically execute the transfer of ownership when certain conditions are met, such as the receipt of payment. This eliminates the need for intermediaries and reduces transaction costs and time.

It is easier to demonstrate the practical examples of tokenization through the particular cases, which are provided below. Thus, we are going to explore the tokenization in the following spheres:

The creation of fractional ownership can boost the real estate industry. Let us suppose, the property owners need money to tackle some problems. Since it’s hard to sell the hotel as a single asset and it takes a lot of time, tokenization can help to address the issue without the necessity to sell it.

The first real estate deal with the help of tokenization was completed in 2018. The St. Regis Aspen, a luxury hotel with views of the Rocky Mountains, offered the public to become owners of 20% of the property through digital currency. It released 20% of ownership in Aspencoins, thereby presenting an opportunity for individuals to attain the status of true owners of the exquisite property. As it was reported, it was possible to spend as little as $100, $1,000, $10,000 or some other amount to become a co-owner of the hotel.

Numerous blockchains such as Ethereum, Solana, Binance Smart Chain, etc. enable smart contracts, which allow to program digital assets for including ownership rights and transaction history. Smart contracts are pieces of code or programs that run automatically when certain conditions are met, hence don’t need intermediaries. In other words, these are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code.

A smart contract is a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code.

The tokens, created as a result of tokenization, include rules that ensure compliance of the asset issuing, distribution, etc. It means that everyone is playing by the same rules. For instance, real estate tokenization can include controls for ensuring the transfer of tokens to the particular counterparties (the terms are specified in the smart contract).

Tokenization of precious metals can be a great alternative for people who want to diversify their portfolio. Let us take gold, for instance. The popularity of this investment option is indisputable. It’s been a reliable inflation hedge for centuries, bringing stability to investors during market volatility.

However, it wasn’t so easy to invest in it. It has always been a headache for people to keep it safe! People used to store it in temples, bury it in the ground, store it in guarded vaults, strongrooms, and heavily fortified castles. Now more sophisticated methods are employed. Many central banks store their gold reserves in secure underground vaults, often protected by advanced security systems like biometric scanners and armed guards. Private individuals can store their gold in specialized vaults and depositories, with high-tech security measures like motion sensors, cameras, and even armed guards.

Buying tokenized gold, you don’t have to worry about its storage. Buying and selling real gold is really a hassle! You have to find a reputable dealer, negotiate a price, and physically transport the gold. Tokenization is an excellent solution that removes all these problems.

With tokenized gold, you can purchase it with just a few clicks from anywhere in the world using Euros, US dollars, Ether, Bitcoin or some other crypto. It is possible to transfer the tokens to any Ethereum wallet or even receive physical gold through global delivery if you decide to.

Art is often considered a luxury investment, only available to the wealthy elite. But what if everyday people could own a piece of a masterpiece by Van Gogh or Monet? Tokenization broke down barriers, so any person can own million-dollar assets nowadays.

Artwork tokenization involves converting the ownership rights of a physical artwork into digital tokens that can be traded on a blockchain. This allows multiple investors to own a stake in a single artwork, making art investing more accessible and democratic. And the benefits don’t stop there. Tokenization also allows for greater transparency in the art market, reducing the risk of fraud and ensuring fair pricing. We have previously discussed how NFTs can help regulate music copyright ownership through blockchain technology. The use of NFTs in the music industry can help make the relationship between musicians and their fans stronger by sharing royalties with supporters. It can also change the current music business model and enter a new era where artists can become independent, and fans can earn along with their favorite bands.You can read more about it in our project “What da hack is music royalty NFT?!”.

Various asset management platforms are now offering a unique opportunity for art enthusiasts and investors alike. With their recent foray into art tokenization, even everyday people can now invest in renowned artworks from world-famous artists like Picasso, Warhol, and Koons using cryptocurrency. This innovative move has opened up exciting new possibilities for those looking to invest in museum-quality art and watch its value grow over time.

In 2021, a Swiss-based bank achieved a significant milestone by using blockchain technology to transfer ownership rights of Picasso’s 1964 masterpiece, Fillette au béret, onto the blockchain. The artwork was divided into 4,000 digital tokens, which were sold to over 50 investors at a price of 1,000 Swiss francs ($1,040) per token. This innovative approach to art ownership allows more people to invest in high-value artworks without the need for large sums of money or specialized knowledge of the art market.

Tokenization in logistics refers to the use of blockchain technology to digitize and tokenize logistics assets and processes. This allows for more secure and efficient tracking, verification, and transfer of goods and services throughout the supply chain. It can be used to represent cargo, shipping containers, or other logistics assets as digital tokens on a blockchain network. This enables easy tracking and monitoring of these assets in real-time, from the point of origin to the point of destination.

It contributes to better transparency and security in logistics transactions by creating a tamper-proof record of ownership and transfer of goods. This can help prevent fraud and reduce the risk of errors and delays in the supply chain.

There are several examples of tokenization in logistics. For instance, in 2019, Maersk, the world’s largest container shipping company, partnered with IBM to launch TradeLens, a blockchain-based platform for tracking and tracing shipping containers. The platform uses tokenization to represent shipping containers as digital tokens, allowing for real-time tracking and monitoring of their movement and condition.

Another example is Walmart’s use of blockchain technology to track the supply chain of pork in China. The company partnered with IBM to create a blockchain-based system that tokenizes pork products, allowing for easy tracking and monitoring of the entire supply chain, from the farm to the store. This ensures greater transparency and accountability in the supply chain, reducing the risk of food contamination and other issues.

Whatdahack?! provides a full package of services for the digitalization of your business, such as Web 3, NFT, cryptocurrency, Open source, etc.

We also participated in the development of the logistics industry product by developing a blockchain system for Volvo Trucks. This product helps aggregate fleet data to a single system allowing bird view control and longer vehicle usage periods.

Currently, there are many collectibles that are being actively tokenized, including sports cards, coins, stamps, rare artwork, vintage cars, luxury goods, and even wine.

For instance, a Swiss company tokenized a rare 1930s Mercedes-Benz 300 SL “Gullwing” model, which is highly sought after by car collectors and enthusiasts. The car was turned into “digital tokens,” which allowed investors to own a fractional share of the vehicle. The tokens were sold to investors through an online platform, with the total value of the car being divided into 20,000 tokens. Investors who purchased the tokens were then entitled to a share of any profits that were generated when the car was sold or leased. The car was ultimately sold for $1.8 million, and investors received a return on their investment based on the number of tokens they owned.

Tokenization penetrated the sports industry as well. Many popular football clubs issued their tokens to boost revenues. As more and more football clubs join the exciting tokenization game, they’re not just looking for new ways to score on the pitch. Now they’re also looking to score big on the blockchain!

With the rise of fan tokens, supporters can now become team shareholders and vote on minor club decisions. Holding fan tokens can also unlock VIP rewards like meeting favorite players or sportsmen and securing exclusive seats. Fan tokens can even provide access to a team’s rare memorabilia, which can increase in value over time. Fan tokens can be bought and traded like other crypto assets, and their value is subject to external factors like market trends and fan interest since it helps to generate a new form of engagement experience.

The same is true for indie artists who turned to tokenization to raise money through the token launch. It helps them to break free from mainstream labels, while investors can support their favorite singers and contribute to their career growth. Singer tokens offer numerous perks such as access to merchandise and concerts. Besides, this is a method to invest in the music industry with the goal of getting potential profit if the artist’s career takes off. It is worth noting, however, that investing in any asset carries risk, and the value of singer tokens can fluctuate based on market conditions and the success of the musician or band. Anyway, music lovers enjoy the experience so this is the investment that truly rocks! With singer tokens, your personal concert pass never expires.

It seems like almost anything can be turned into a digital asset nowadays. The ability to tokenize assets is unlocking new possibilities for investors and asset owners alike, offering a new way to trade and exchange ownership stakes in all kinds of things. As the world gets more and more tokenized, many talented individuals are getting in on the game! Also, a number of innovative projects have emerged that seek to leverage this technology in new and exciting ways. Let us take, for instance, the Talent Protocol, which enables artists, musicians, and other gifted people to create their own tokens and let fans and investors participate in their success. At this, patrons of hidden talents are rewarded for their discovery. It’s like buying stock in your favorite musician – only way cooler, because you can say that you own a piece of their talent. Move over, monopoly money – talent tokens are the hot new way to invest in your favorite stars.

Investors can always add a little sophistication to their portfolio, investing in tokenized whiskey! Many prefer to invest in it since it is not just a drink but a lifestyle. Moreover, a high-class hobby can make some serious money for you.

In 2020, a specialized digital asset fund offered tokenized Scotch whiskey casks to customers worth $1,000 per barrel, which was expected to rise 4 times when it matures in 5 years. At the same time, the Singapore exchange offered the tokens of high-end Scotch whiskey collection aged to perfection. The premium whiskey collection is expected to mature from 2022 to 2025. The token holders can trade the asset, which grows in value over time, while real connoisseurs of the drink can opt for physical whiskey delivery.

According to investment experts, rare whiskey has seen a growth of more than 500% in its asset value over the past decade. With the limited supply and high demand for some types of whiskey, it’s no wonder that many investors are turning to it as an alternative investment option during turbulent times. A bottle of single malt scotch seems to be more attractive than stocks and bonds.

While some investors select a rare whiskey token, which may be a luxurious investment, others may prefer the practicality and ease of the water tokens. Given that one-third of the world’s population lacks sufficient water supply for their daily needs, the demand for portable water is on the rise. There are several projects and initiatives related to water tokenization that have gained attention in the crypto and blockchain communities. These projects aim to use blockchain technology to track and verify water usage and ownership, facilitate water trading, and incentivize water conservation and efficient use.

It seems that nothing can escape tokenization, which can be used beyond the realm of traditional finance and assets. Sometimes a huge potential is right underneath your feet! You just need a creative approach to unearth it.

In 2022, the Central African Republic (CAR) came up with a plan to generate investment opportunities in the economy of the country, using this tool. So, it looks like the Central African Republic is jumping on the tokenization bandwagon!

Who knew people could tokenize natural resources? CAR hit the jackpot with all those natural resources like petroleum, diamonds, copper, and more. Since they are so lucky with it, they decided not to sit on all that potential wealth and tokenize it to promote economic growth. And this is a brilliant solution! By doing so, they’re making it easier for investors to get in on the action. Also, it brings more transparency to how they manage natural wealth. No more shady deals in the back room. It’s all out there for everyone to see.

The environmental benefits are also evident. With all that traceability, people of the country can make sure everything’s being managed responsibly. So, this is a win-win solution for all parties involved. Though the process is not that fast since a legal framework should be created for this, CAR is ahead of the game with it. It shows the pattern for others to follow.

Tokenization is no longer just about digitizing assets and streamlining their ownership and trade. With the rise of blockchain technology, some innovators are pushing the boundaries of what can be tokenized. In fact, they are even exploring the potential of tokenizing intangible things like emotions, experiences, and even love.

One of the veterans in the crypto industry Adam B. Levine is a host of the Let’s Talk Bitcoin podcast with over 500 episodes. The podcast has become one of the best Bitcoin podcasts over the web. To facilitate conversation and engagement on the Let’s Talk Bitcoin platform LTBCoin was issued, which can be referred to as a talking coin. It was designed to be earned by users for contributing content and participating in discussions on the platform, which incentivized community engagement. The concept of a talking coin is closely tied to the idea of community building and engagement through blockchain-based rewards systems.

LTBCoin played a role in the early adoption and development of cryptocurrencies and blockchain technology. While it may not have directly kickstarted the token revolution, it was one of the first tokens to be built on the Bitcoin blockchain, which paved the way for the development of other tokens and the wider use of blockchain technology in various industries.

The project of a podcast can be considered an early example of tokenization. It was one of the first tokens to be built atop the Bitcoin blockchain, representing a specific asset (content on the Let’s Talk Bitcoin network) and enabling users to trade, transfer and use it within the network. This laid the foundation for the development of more advanced tokenization use cases, including those we see today in various industries.

One of the startups leveraged tokenization to create limited-edition streetwear that’s unique and easily verifiable. Using smart contracts on the Ethereum blockchain, the company creates digital tokens that represent specific pieces of clothing. A smart technology is used to avoid dodgy replicas and extortionate resales. These tokens are then sold to customers, who can claim their physical counterparts once they’ve received the digital asset. The tokens can also be traded on secondary markets, creating a new form of collectibles for streetwear enthusiasts. The technology helps the company ensure that each item of clothing is unique and not counterfeit, and allows customers to track their purchases from production to delivery.

It means that there is no need to empty the bank account to acquire a piece from your favorite fashion designer. There is also no necessity to line up in the street and wait for hours in rain, hail, or shine, as it often happens on the days of the latest streetwear drops. The collectible streetwear becomes more accessible for token holders.

Tokenization can be also used to protect people’s digital identities. The founder of such a project states that it is one of the biggest challenges for businesses and individuals. Hence, it is necessary to secure digital identity to prevent the threat of identity theft. The identity token was released to solve the problem and create a more secure and trustworthy digital world.

Many companies try to get in on the cannabis industry that is worth more than 50 billion USD in the USA alone and it shows no signs of slowing down. One of the startups tries to leverage the blockchain technology to create a transparent and secure supply chain, making it easier for companies to track and verify the origin of their products. Since recreational marihuana is legal in 10 states of the country, while 33 states have legalized its medicinal use, the potential is huge and high tech technology can contribute to its growth.

People are very creative and very human no matter what they do. Numerous studies were conducted that tried to measure emotion. Scientists investigated the subject for years. The main problem is digitization of the metrics around such non-financial value items as love, happiness, hope, and, in theory, these things can be transacted on a blockchain.

Dr. Hugo Liu is actively working on a project to tokenize love. He believes that love can be quantified and represented as a token on the blockchain. He plans to create a system that allows people to send tokens of love to each other, which can then be traded, collected, and even used as collateral for loans. Some people are skeptical about the idea, while others are intrigued by the concept and see potential in it.

The concept may sound crazy, but it has caught the attention of many people in the tech and finance industries. In this article, we will take a closer look at some of the weird and wonderful ways in which tokenization is being used, and how it could potentially change the way we experience the world around us.

According to the report released in September 2022, the potential of tokenization in the near future is huge. It predicts 50 times market growth, thus reaching 10% of GDP by 2030, which is more than 16 trillion USD. Professionals expect the rise in such spheres as real estate, equities, bonds and funds. It is going to bring significant changes to the business landscape and form a new reality we will have to adapt to.

The advent of tokenization has democratized the market of alternative investments, making it more accessible to a wider range of investors. By transforming illiquid assets like real estate, art, and even whiskey into digital tokens, tokenization has opened up new investment opportunities for individuals with lower net worths. High-end assets that were once the exclusive domain of the ultra-rich are now being democratized and diluted among token holders. With tokenization, anyone can now invest in assets that were previously out of reach, changing the face of investing and wealth creation.

Blockchain transforms the market and ports its model into places where it couldn’t go before. Since the reach of the market extends beyond traditional asset tokenization, it brings new forms of private assets into the focus. We can invest in anything we want, whether it is an enterprise, an art, a singer, a favorite football team, or other assets with traditionally low liquidity. The tokenization process can help to even it out.

Distributed ledger technology employed in tokenization ensures immutability, great transparency and high level security. Smart contracts can’t be misplaced from the blockchain or modified unless this action is initially programmed. It presupposes more convenience and better overall security. Taking into account such benefits as low transaction time, lack of middlemen, and cost-efficiency, tokenization can help to attract investments faster and easier, thus ensuring higher revenues for investors.

Tokenization has the potential to change the landscape of the market since it opens investment to a wider pool of investors. We are just in the early phase of its adoption but its impact is seen already. Digitization helps to facilitate the innovation of new product offerings. It also implies a more democratic approach to investments in expensive assets, such as commercial real estate.

Being highly divisible, tokens remove the need for minimum investments, which is a win-win situation for both parties. Investors can participate in the projects which were inaccessible for them before. Being an easily transferable unit, and representing real value, tokens help to make assets liquid or easily tradable. Instead of registering ownership in the old-fashioned way on paper, investors can transact digitally using tokens. All these factors taken together result in the mitigation of entry barriers to many industries, ensuring a broader investment base, more liquidity in the market and, hence, a more vibrant economy.

Illustrator – TBA

Copywriter – Olga Polina

Editor – Damo Jackson

Project Coordinator – Irene Mishina

Producer – Roman Gorbunov