This is an article produced by Whatdahack?! and also presented as a YouTube video AI-agentic Solutions Saving Millions: How AI Boosts Software Development Lifecycle (Real Use Case).

AI is taking over! Or is it? You’ve probably heard the hype, the hate, and the fear. Some say AI will steal jobs, others say it’s useless. The reality? It’s neither. AI isn’t magic, and it’s not a doomsday machine – it’s a tool. A powerful one. The real question is, how can we use it effectively?

Every new technology comes with skepticism. The internet was once ridiculed as a fad. People thought social media wouldn’t last. Yet, here we are. AI-agents are on a similar trajectory, and the sooner we understand their role, the better we can leverage them.

But first, what exactly are AI-agents? Why are they different from traditional AI? And most importantly, why should you as a business owner care?

Hello, my name is boogieman aka Roman Gorbunov and I have hands-on experience building and integrating AI-based solutions into software products or business processes. And today in this video I will share my vision of how AI-agents will change businesses based on real use cases from my professional experience. Buckle up, it is going to be exciting.

The rise of AI and AI-agents has not only sparked excitement but also a wave of exaggerated claims, especially on YouTube. Many AI software development YouTubers exuberantly promote the abilities of AI with clickbait titles like ‘Build a Fully Fledged Application in 15 Minutes!’ or ‘AI Will Replace Developers Completely!’ — claims that are often misleading and far from reality. While AI can significantly enhance and accelerate software development, it is not a magic wand. Building robust applications still requires a solid technical background, strong problem-solving skills, and a deep understanding of software development processes. These so-called ‘AI gurus’ often oversimplify the complexities of development, creating false expectations for viewers. This video is my response to those misleading narratives — a guide for anyone seeking real, actionable advice on how to leverage AI in software development without the hype or false promises. No clickbait, no sales pitch — just honest insights into how AI can truly transform your workflows when used responsibly and with the right expertise.

Every industrial revolution has fundamentally reshaped the way we work and live. The first industrial revolution introduced steam power, enabling mechanized production and transforming industries like textiles and transportation. The second brought electricity and mass production, revolutionizing manufacturing with assembly lines and making goods more affordable and accessible. The third gave us computers and digital systems, automating calculations, data processing, and communication on a scale never seen before. Now, we’re in the midst of the fourth industrial revolution—driven by automation, artificial intelligence, and interconnected systems.

But AI-agents aren’t just another incremental software upgrade. They represent the next generation of tools in the ongoing quest for increased productivity. To understand their significance, let’s look at history. In manufacturing, the introduction of machinery replaced manual labor for repetitive tasks, allowing workers to focus on more skilled roles. Later, robotic arms on production lines automated precision tasks like welding and assembly, improving efficiency and reducing errors. These innovations didn’t eliminate the need for human workers – they enhanced their capabilities and allowed them to focus on higher-value activities. AI-agents are the digital equivalent of this evolution.

Whether you’re a developer, a business owner, or just curious about the future of AI, this video will help you understand why AI-agents are a game-changer. And no, you don’t need a PhD in machine learning to get started.

As an independent consultant with extensive hands-on experience in developing and integrating AI-driven solutions for businesses, I know firsthand that AI development and integration is a knowledge-intensive process. It’s not a one-size-fits-all solution, nor is it something that can be effectively handled by inexperienced individuals or so-called ‘AI gurus’ who lack the necessary technical depth and real-world expertise. Successfully implementing AI requires a senior level of experience, a deep understanding of business processes, and the ability to navigate the complexities of AI systems.

Business owners must be cautious when choosing who to trust with their AI initiatives. Working with unqualified professionals can lead to poorly designed solutions, wasted resources, and even harm to your business or idea. That’s why I focus on delivering tailored, high-quality solutions that align with your unique needs and goals. From strategic planning to deployment and optimization. Don’t leave your business in the hands of amateurs – partner with a professional who understands the stakes. Visit my website to learn more and start your journey toward AI success.

In 2017, the seminal paper “Attention is All You Need” introduced the transformer model by Vaswani et al., which revolutionized the field of NLP by enabling models to understand and generate language with unprecedented efficiency. This breakthrough laid the groundwork for subsequent models capable of translating human language into executable code.

Building on this foundation, OpenAI released GPT-3 in 2020, which demonstrated remarkable proficiency in generating human-like text and performing a variety of language tasks. This development paved the way for the birth of OpenAI Codex in August 2021, a model specifically tailored for code generation. Trained on code from over 54 million GitHub repositories, Codex was designed to parse natural language instructions and convert them into programming code across multiple languages. This capability was further popularized by its integration into GitHub Copilot, which provided real-time code autocompletion and assistance to developers, significantly enhancing productivity in software development.

These tools have revolutionized the Software Development Life Cycle (SDLC), enabling developers to describe tasks in plain language and have AI generate, debug, and optimize code. However, while these tools enhance productivity, they still require technical expertise to use effectively, emphasizing the need for skilled professionals in leveraging AI for software development and they do not present a complete, end-to-end solution allowing to deliver production ready software products. However, with the introduction of AI-agents, enhanced LLM, Software Development Life Cycle, as many other business use cases, has received a tremendous opportunity for development teams’ productivity and significant reduction in technical & security risks.

Artificial Intelligence, or AI, refers to systems that mimic human intelligence, often designed for specific tasks like fraud detection or image recognition. However, AI-agents take this a step further, they’re autonomous systems that don’t just follow predefined rules but analyze, learn, and act based on goals. Unlike traditional AI, which is static and task-specific, AI-agents are dynamic and adaptive, capable of handling complex workflows and making decisions independently. A key technology behind modern AI-agents is Large Language Models, or LLMs, like OpenAI’s GPT. These models are trained on massive datasets, enabling them to understand and generate human-like language. For example, tools like ChatGPT can simulate conversations, while AutoGPT can break down complex goals into smaller tasks and execute them autonomously. Imagine a customer service AI-agent: it doesn’t just answer FAQs but learns from interactions, improves over time, and escalates issues intelligently when needed. This is a huge leap from traditional chatbots, which rely on static scripts. By combining the adaptability of AI-agents with the language understanding of LLMs, businesses can automate entire functions, improve decision-making, and achieve greater efficiency. However, these systems still require proper expertise and oversight to unlock their full potential.

AI-agents are transforming industries by reshaping workflows and enabling unprecedented efficiency in many areas. Here are some key applications:

AI’s potential goes beyond isolated tasks, it transforms entire workflows. And this is especially evident in software development, where AI is revolutionizing the entire process, from planning to deployment.

The Software Development Life Cycle (SDLC) is a structured framework for building software, consisting of several key phases: planning, design, coding, testing, deployment, and maintenance. Of course, with Agile practices applied you iterate all the phases delivering small product increments, so you repeat this circle steps each sprint until a final result is reached. Each phase requires careful coordination to ensure the final product meets user requirements and business goals. Traditionally, these processes have been manual, time-consuming, and prone to human error, especially in complex projects. The biggest cost in human communication is brought by knowledge transaction cost and the smaller this cost the faster and the better product your development team delivers. However, the introduction of AI-agents is transforming how these phases are executed, making the process faster, more efficient, and less error-prone.

As we already understood, The Software Development Life Cycle (SDLC) has always been a complex process which included multiple phases where various specialists must be involved.

Over time, various tools and methodologies have been introduced to optimize it.

In the 1940s-1960s, programming was manual, with developers writing machine-level instructions. The introduction of high-level languages like Fortran, along with compilers, simplified coding. The 1970s Waterfall model brought structure with a linear, phase-based approach, but its rigidity made adapting to changes difficult. Tools like flowcharts and Gantt charts supported this model.

The 1980s introduced iterative models, enabling feedback loops and partial implementation. CASE tools automated parts of the process, such as code generation. The Agile revolution in 2001 emphasized flexibility and iterative development, with tools like Jira and Trello improving collaboration.

In the 2000s-2010s, DevOps and CI/CD practices automated building, testing, and deployment, using tools like Jenkins and Docker to speed up releases. Low-code/no-code platforms like OutSystems further simplified development, allowing non-technical users to create applications.

While these advancements improved efficiency, SDLC still required significant manual effort, paving the way for AI and LLMs to automate complex tasks and streamline workflows.

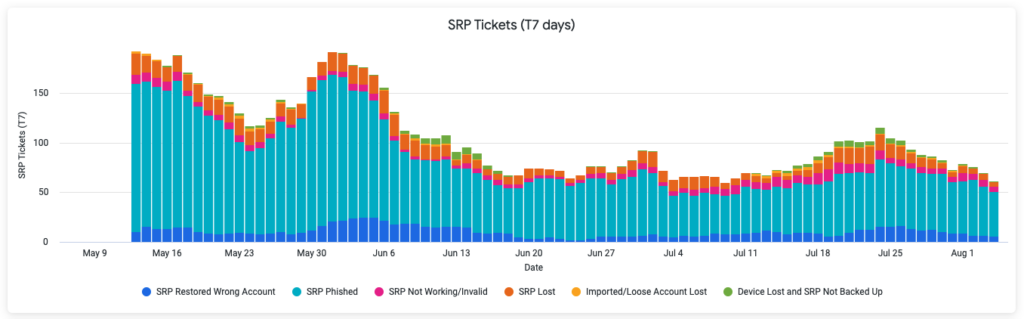

Integrating AI into the Software Development Life Cycle (SDLC) requires a detailed understanding of each phase. By breaking down and documenting workflows, we identify opportunities for AI to add value and ensure each phase provides the necessary inputs for the next step in the integration process. This structured approach not only enhances efficiency but also maximizes the impact of AI tools on the development process. A great example of this is the AI-enhanced software delivery process illustrated in the chart provided, which breaks down the journey from idea to development into three key phases: Ballpark Estimation, Detailed Estimation, and Project Infrastructure Setup. Let’s explore how this process aligns with the SDLC phases and how AI integration transforms each step. I want to highlight that this scheme is designed with a very simple software product to be developed in mind, thus estimation and initialization of a more complex product will require more time and effort respectively.

The planning phase is where project goals, timelines, and costs are defined. This phase provides the foundation for AI-driven estimation and prioritization. In the Ballpark Estimation Phase (as shown in the chart), AI tools analyze initial project inputs and historical data to generate quick estimates within 30 minutes. And, of course, it will be crazy to fully rely on those estimations, but as my experience proves with a properly written prompt you’ll get a pretty accurate numbers range which is enough to get going.

DM with a short message “Software Development Estimation Prompt” to my LI account from a verified account and I will be happy to share my unique prompt with you.

This rapid estimation process allows stakeholders to make informed decisions early, saving time and effort compared to traditional manual methods. Documenting these high-level requirements with AI-tools as well ensures that the next phase has a clear starting point with pre-generated information architecture diagram, backlog draft and high-level user stories documented, technical stack recommendations outlined.

The design phase focuses on creating detailed workflows, system architecture, and user experience designs. In the Detailed Estimation Phase, business analysts and solution architects use AI tools and diagramming platforms enhanced by AI to refine requirements and create system diagrams, wireframes, and user journey maps. Inputs such as user behavior data and industry best practices guide AI in suggesting improvements and ensuring alignment with business goals. This phase provides the technical and functional clarity needed for the coding and infrastructure setup phases which also serve already both as a production requirement and project charter artefacts to share with development teams and streamline their onboarding.

Coding: Setting Development Frameworks

The coding phase involves setting up the project infrastructure and writing the initial codebase. In the Project Infrastructure Setup Phase, AI tools automate the configuration of cloud environments, CI/CD pipelines, and other infrastructure components. By documenting the development environment, reusable code libraries, and coding standards, we ensure that AI can assist in code generation, optimization, and infrastructure setup. This automation reduces setup time, ensures consistency, and minimizes human error, allowing developers to focus on high-value tasks. And again, I know there are already platforms and tools allowing developers to launch projects on their infrastructure deploying right away to production even without any functionality ready. In our case I speak about a project requiring a more complex infrastructure, something like a web and a mobile client communicating with multiple backend servers and third-party applications.

Testing: Establishing QA Parameters

The testing phase ensures that the software meets performance, reliability, and security standards. I bet you might have seen memes about startups hiring one vibe coder at one price and then hiring a couple more senior developers at a double higher rate to fix the bugs generated by the vibe coder. And to be honest I do not think we will see a 100% accurate result generated by AI in the near future. Yes, the context window is growing, but just from empirical experience human review and user acceptance tests will now go away any soon. That is why a normal practice will be to outline test cases, scenarios, and metrics for software quality. Historical bug data and user feedback are critical inputs that allow AI to simulate user behavior, identify edge cases, and detect vulnerabilities. This automation not only accelerates the testing process but also improves accuracy and reduces the risk of errors.

Deployment: Outlining Release Strategies

The deployment phase focuses on releasing the software to testing and further to production. Deployment workflows, performance metrics, and monitoring requirements are documented to help AI automate and optimize releases. AI-agents tremendously increase a lot of manual setup work, however their ability to monitor performance metrics during deployment, identify potential bottlenecks, and ensure smooth rollouts is a new potential a few developers yet leverage. This proactive approach minimizes downtime and ensures a seamless user experience.

Maintenance: Monitoring and Feedback

The maintenance phase involves monitoring system performance, analyzing user feedback, and implementing updates. AI tools use real-time performance data and feedback to recommend optimizations, predict system failures, and prevent downtime. By documenting maintenance schedules, update plans, and anomaly patterns, we ensure that AI has the necessary inputs to support long-term system stability and improvement.

The AI-enhanced software delivery process chart exemplifies how breaking down and documenting the SDLC at a granular level enables effective AI integration. Each phase is clearly defined, with inputs and outputs that guide the next step. For example:

By thoroughly understanding and documenting each phase, we create a roadmap for AI integration that ensures tools are applied efficiently and effectively. This structured approach not only enhances productivity but also reduces costs, shortens development cycles, and maximizes the value AI brings to the software development process.

So once you documented the whole business process workflow or part of it as in our example. The next step is to decide what tools to integrate. Choosing the right AI tools is a critical step in successfully integrating AI into your workflows. With the rapid advancement of AI technologies, a variety of platforms are available to suit different needs, from advanced developers to non-technical users. For non-technical users, no-code/low-code platforms also democratize AI integration, however in more complex use cases it still requires a solid technical background to realize certain automation.

The accessibility of these platforms ensures that businesses of all sizes, not just large enterprises with big budgets, can leverage AI to enhance productivity and efficiency. Whether you’re a developer looking for advanced tools or a business owner seeking simple, cost-effective solutions, the best rule to select the right solution is to estimate efforts needed and compare it against future benefits brought by the improvement. Thus we came to understanding the investment potential of AI-agent integration.

Integrating AI into your business is about creating real value, not just automating for the sake of it. Unfortunately, the rise of fake gurus and overhyped promises has led to misguided implementations that fail to deliver meaningful results. Successful AI integration requires a clear understanding of your business processes, goals, and the potential return on investment (ROI).

Some examples of poorly thought-out AI implementations highlight the importance of understanding the why behind automation. For instance, businesses using AI-agents to comment on social media under fake avatars may think they’re boosting engagement. However, when people discover that an AI is behind the comments, especially on serious or sensitive topics, it often upsets users and damages trust. Similarly, using AI to sort and reply to massive volumes of emails without understanding the purpose of the communication can lead to irrelevant responses, wasting resources and frustrating recipients. Another example is mass-producing AI-generated blog content without considering quality or relevance, which can harm a brand’s credibility.

To avoid these pitfalls, businesses must focus on meaningful automation that solves real problems. Our AI-Agent ROI Calculator helps you do just that by analyzing key factors such as:

For example, automating a customer service process with AI can reduce response times, lower staffing costs, and improve customer satisfaction. Since we integrated AI-powered tools to our SDLC we’ve seen a 30-50% increase in development speed and fewer errors, leading to faster delivery and lower costs. Don’t fall for empty promises or waste resources on misguided implementations. Use our AI-Agent ROI Calculator (DM with “AI-Agent ROI Calculator” to access the file) to make informed, data-driven decisions about AI integration and see how automation can transform your business with real, measurable results.

In upcoming videos, we’ll showcase real businesses that have successfully integrated custom AI-agents into their workflows. And one standout use case is an integrated functionality generating PRDs (product requirements artefacts), an AI-agent that transforms how businesses move from idea to execution. The PRD includes key features, user roles, acceptance criteria, and more, giving businesses a clear roadmap for development. From there, users can request a quote for AI-powered app development, delivered at a fraction of the cost and time of traditional methods.

Make sure you are subscribed to the channel or blog as we dive deeper into this already realized real-world use cases in the upcoming videos.

We’ve covered a lot today, from debunking AI hype and exposing misguided implementations to showcasing real-world applications and how AI-agents are transforming the Software Development Life Cycle (SDLC). We also teased some exciting use cases with AI-agent streamlining Product Requirements Documenting and shared insights into how businesses can achieve measurable results with AI integration.

In our next video, we’ll explore the evolution of AI agents and how AI-agents have evolved from simple chatbots to powerful tools that drive innovation and efficiency across industries.

Don’t forget to like, subscribe, and hit the notification bell so you don’t miss out. Let’s continue the conversation, how do you see AI shaping the future of your industry? Share your thoughts in the comments below. And if you want to have a text version of this video, check out the blog at the website.

Thanks for watching, and I’ll see you in the next video!

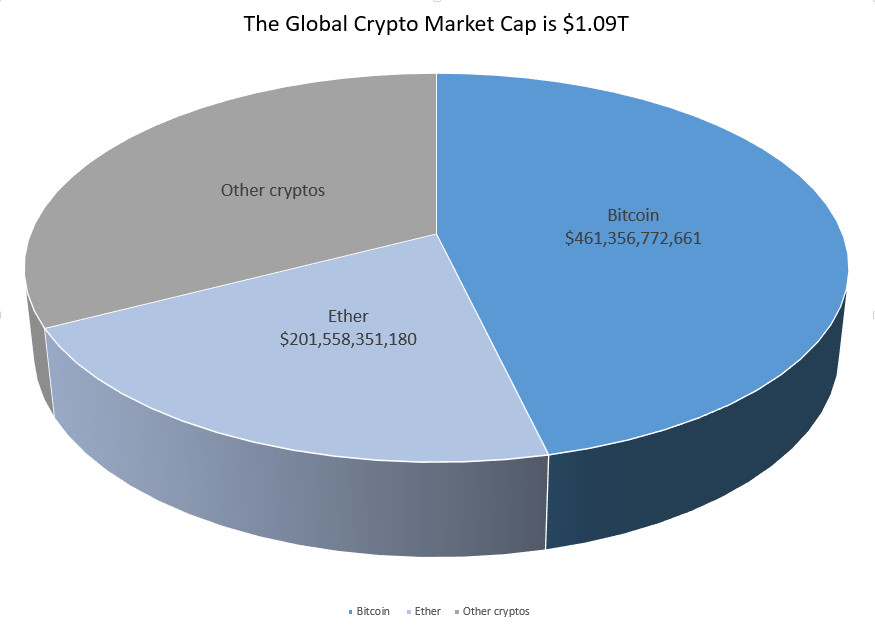

I’ve had the privilege of witnessing the inception of blockchain and crypto wallets, observing their early developments. When the buzz around crypto wallets first emerged, I found it challenging to comprehend. Digital wallets? The concept seemed puzzling, but my curiosity was piqued.

Having now grasped the concept, I’m eager to share some valuable insights about the adoption of crypto wallets, focusing on one particular wallet that has become synonymous with online money storage: MetaMask. Let’s start at the beginning.

Having now grasped the concept, I’m eager to share some valuable insights about the adoption of crypto wallets, focusing on one particular wallet that has become synonymous with online money storage: MetaMask. Let’s start at the beginning.

It all started a while back, but it sparked like a fire in 2009 when people started talking about cryptocurrencies. Shortly after introducing the first cryptocurrencies, it became evident that a secure storage solution was needed. Keeping this new type of currency in mattresses or sugar bags, as done before, was simply impossible. This is where digital wallets come into play, they are virtual piggy banks in the digital realm.

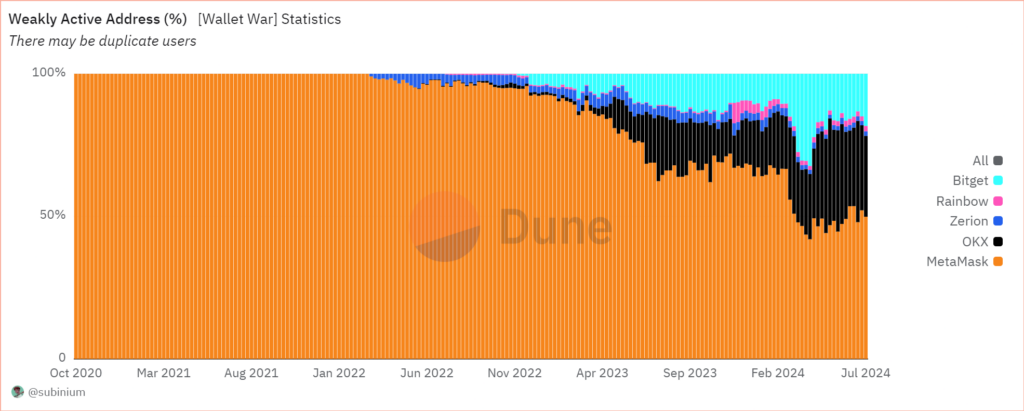

When discussing crypto wallets, the prominent name of MetaMask immediately comes to mind. This wallet has earned a reputation as the top player for storing various ETH-based tokens. Indeed, MetaMask is a robust crypto wallet. Throughout its existence, the ConsenSys product has generated millions of dollars for its creators and significantly advanced technology. It’s high time to delve into what exactly MetaMask is and how the company generates revenue, explained in simple terms.

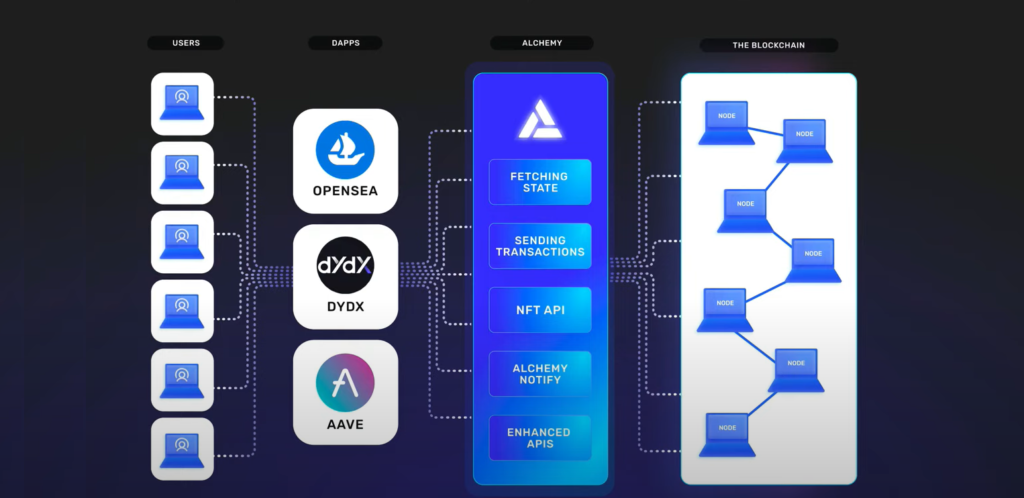

MetaMask is primarily known as a digital wallet designed to facilitate the seamless transfer and management of cryptocurrencies. Besides its primary functions as a wallet, it also serves as an identifier to access specific online platforms and services via identity verification and interaction authentication. At its core, MetaMask is a browser extension that acts as a crypto wallet and a gateway to various decentralized applications, or “dApps.” It enables you to manage your digital assets, interact with dApps, and execute transactions on the Ethereum blockchain – all from the comfort of your web browser.

Before we dig into the history of the MetaMask wallet, it’s important to describe the state of crypto wallets before their emergence. The earliest crypto wallets followed the birth of Bitcoin in 2009.

These wallets operated through command-line interfaces, requiring users to interact with them via text-based commands in a terminal or command prompt. Though functional, their complexity made them less user-friendly, primarily catering to early adopters and tech-savvy individuals. Bitcoin Core stands out as the most renowned command-line wallet.

To make cryptocurrency more accessible to the general public, the second generation of software desktop wallets arrived fairly soon. These were graphical user interface (GUI) desktop applications, providing a more intuitive and user-friendly experience.

As cryptocurrencies gained popularity, web-based wallets were introduced. The third generation of crypto wallets brought about a significant shift in accessibility and usability. Many third-generation wallets were accessible through a web browser, offering more convenience but also raising security concerns as private keys were stored online. MetaMask, in particular, played a pivotal role in this evolution.

MetaMask’s journey began in 2016 as a humble open-source project by ConsenSys, a blockchain technology company. Originally designed to enable regular users to easily interact with Ethereum’s blockchain, it quickly gained traction due to its intuitive design and user-centric approach. The intensive organic growth paved the way for its official launch in 2016, and it has since evolved into an indispensable tool for the crypto ecosystem.

MetaMask seamlessly integrates with web browsers like Chrome and Firefox, allowing users to manage their Ethereum-based assets directly within their web browsers. This innovation has significantly enhanced the convenience of interacting with decentralized applications (dApps) and the Ethereum blockchain, eliminating the need for users to download and install standalone applications. MetaMask’s success has, in turn, sparked the development of similar browser extension wallets for other blockchains, ushering in a new era in crypto wallet accessibility and adoption.

MetaMask boasts an array of advantages. First, it provides a user-friendly interface compared to its predecessors and competitors, making it accessible to both newcomers and experienced users. The convenience of a single wallet for multiple dApps eliminates the need to manage different accounts for various platforms or download separate wallet applications. MetaMask supports desktop and mobile devices, allowing users to access their wallets across various platforms. Additionally, it supports multiple types of cryptocurrencies, functioning like a Swiss Army knife that can handle different tokens.

However, like any tool, MetaMask has its downsides. As a browser extension, it is inherently tied to the security of your browser, and if you’re not careful, online attackers could attempt to steal your tokens. In mid-2022, some research identified certain encryption issues and clickjacking vulnerabilities in MetaMask which were eventually fixed. However, the risk remains as the product and the tech develop, and there is no entity providing financial insurance in case the risk occurs. ConsenSys even offers a monetary bounty for users who find and report vulnerabilities. Although this is a common problem for all decentralized products, other alternative wallets can provide stronger security if that is a major concern for a user.

MetaMask Snaps will function a lot like an Apple App Store for the crypto wallet, allowing third-party developers to launch new decentralized applications (DApps) — dubbed Snaps — that expand MetaMask’s functionality.

Additionally, the dependency on the Ethereum network can result in slower transaction speeds during peak usage times. Unlike MetaMask, some competitors support multiple blockchains, offering a broader range of cryptocurrency support.

You might wonder, if MetaMask doesn’t use traditional ads and subscription models, how does the company sustain itself? As ConsenSys operates as a privately owned entity, it is not obligated to disclose its annual financial reports to the public. Yet, given the transparent nature of blockchain transactions, we can make approximations regarding their earnings.

Surprisingly, these estimates point to an annual revenue exceeding $200 million. Remarkably, as reported by TechCrunch, the company’s overall valuation surpasses $7 billion, following a successful fundraising effort that garnered over $450 million in capital as of March 2022. So, how does MetaMask make money out of over 30 million monthly active users if the service they offer is free? Let’s take a closer look by breaking down the main sources of income.

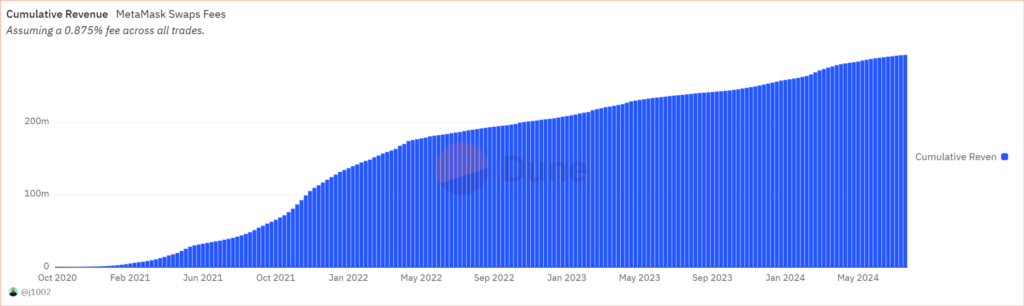

MetaMask operates on an open-source model, meaning the core functionality is freely available to users. However, it offers a gateway to various decentralized services and applications, many of which have their own revenue models. A significant portion of MetaMask’s revenue comes from swap fees. Introduced in October 2020, this feature empowers users to seamlessly compare and execute token swaps directly within the MetaMask platform.

For instance, when you use MetaMask to interact with a decentralized marketplace or a gaming dApp, the dApp developers might charge fees or take a small percentage of transactions. In return, MetaMask can form partnerships or collaborations with these dApp developers, receiving a portion of the fees generated from transactions facilitated through its platform. One such example is the integration of the MetaMask Wallet with the Unity Engine.

Typically, a service fee for these swap services ranges from 0.3% to 0.875%. This fee is seamlessly integrated into the trade quota, which also encompasses gas fees. MetaMask goes the extra mile to ensure users can access an extensive array of tokens, effectively curbing prices and gas fees. Moreover, to address slippage issues, MetaMask enables users to set their maximum threshold. Orders exceeding this threshold are automatically canceled, enhancing user control.

In September 2023, MetaMask introduced a new feature that will completely change the rules of the financial system. Previously, users could speculate with crypto assets within decentralized platforms, and cash remained the prerogative of centralized solutions – it’s time for a new alternative.

The integrated approach turns MetaMask into a fiat gateway, where investors can not only sell cryptocurrency but also convert it into fiat currencies and store it in bank accounts.

Initially available in the US, UK, and select regions of Europe, MetaMask has expressed its intentions to expand this service to other geographical areas in the future. The feature will initially support ETH on Ethereum Mainnet, with plans underway to extend its compatibility to native gas tokens on layer 2 networks.

Here are the instructions on how to utilize this innovative feature:

This eliminates custodial control over assets, expands account capabilities, and provides access to this function for users worldwide. It is safe to say that this is only the first step against traditional solutions, where banks remained leaders in the field of asset storage.

The innovation opens up a pool of benefits for MetaMask users:

The introduction of this update is significant as MetaMask continues to be the go-to tool for engaging with the decentralized ecosystem, particularly decentralized exchanges and decentralized finance (DeFi) protocols. By offering users the ability to withdraw funds directly from their self-custody wallets to their bank accounts, MetaMask empowers individuals to embark on a seamless end-to-end cryptocurrency journey, eliminating the need to rely on centralized exchanges. This development is particularly noteworthy as centralized platforms have faced mounting skepticism in recent months and years.

It is still unknown how MetaMask is going to monetize this functionality. At the moment, one thing is clear – this will be in great demand among users and will definitely bring a lot of profit to the wallet.

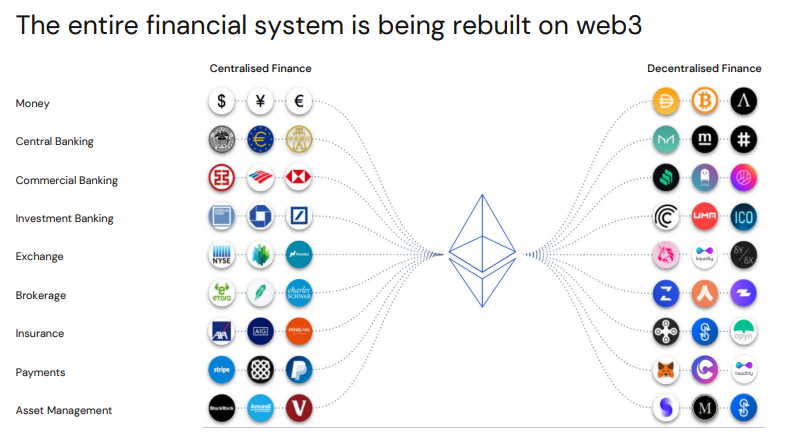

Today, the entire financial system is undergoing a transformation towards Web3. Centralized services, traditionally dominant in Web2, are merging with decentralized solutions to form a unified financial system. This ecosystem includes fiat currencies, central banks, exchanges, crypto assets, and exchangers, within which MetaMask is expanding its influence, not just limited to cryptocurrencies.

In addition to earning revenue through swap fees, MetaMask likely benefits financially from its specialized product, MetaMask Institutional. This tailored wallet caters specifically to the needs of trading firms and financial organizations. A recent example of such collaboration is its integration with the Qredo Network.

While it shares many functionalities with the standard MetaMask wallet, the institutional version provides access to certified custodians and ensures compliance with current tax regulations. Among its significant advantages are:

Like other custodial services such as Coinbase Custody, MetaMask likely imposes management fees on its institutional clients. However, MetaMask does not publicly disclose the fees for this service. These fees are typically calculated as a percentage of the assets under management and are generally lower than those charged by traditional financial institutions.

Numerous institutions utilize MetaMask Institutional to execute transactions within DeFi and Web3 protocols, effectively integrating it with their custodian’s platform. MetaMask Institutional is unique as the only multi-custodial Web3 wallet designed specifically for institutional use. It integrates seamlessly with a wide range of custody and self-custody solutions available in the market, meeting a diverse array of institutional-grade custody needs.

MetaMask Portfolio offers a decentralized application (dApp) that provides a convenient way to view and manage your MetaMask accounts and assets. Within the portfolio, you can engage in activities such as buying, swapping, bridging, and staking your assets.

The central feature of MetaMask Portfolio is its dashboard, which consolidates information from up to 10 accounts, allowing you to easily track your total holdings and view their value in your preferred currency. You can access the portfolio at portfolio.metamask.io. On mobile and through browser extensions, simply click the portfolio button on your wallet homepage for quick access.

As MetaMask serves as your gateway to the decentralized web across multiple Ethereum-compatible networks, your dashboard displays assets across these networks. Currently, the supported networks include:

The list of supported networks is constantly growing, enhancing the versatility and utility of MetaMask Portfolio for a wide range of users.

MetaMask diversifies its revenue sources by selling branded merchandise through its online store. In this virtual boutique, people can explore a range of products including t-shirts, hoodies, caps, mugs, and even hardware wallets. Prices for these products range from $15 to $42.

Beyond financial gain, these merchandise sales serve as a powerful branding channel for MetaMask. Users who proudly wear or use MetaMask-branded items contribute to the company’s bottom line and act as enthusiastic brand ambassadors.

ConsenSys may soon introduce a more traditional monetization method for the industry, primarily due to rumors about the launch of MetaMask’s own token. The MASK token will serve as a form of payment within the MetaMask ecosystem and play a pivotal role in governance.

With the MASK token, users can have a say in shaping the platform’s future by proposing and voting on improvements, updates, and new features. This democratization of decision-making aligns with the spirit of decentralization, where power is distributed among the community.

Beyond governance, the MASK token can also provide additional utility within the MetaMask ecosystem, ranging from incentivizing user participation in certain activities to accessing premium features and services.

Despite advanced technological solutions and a seemingly impeccable reputation, even the most promising platforms can have their shadows. MetaMask, despite its undeniable utility, has not been immune to controversy.

As the MetaMask platform gained traction and became an essential tool for crypto enthusiasts, calls for community ownership grew louder. However, the parent company, ConsenSys, found itself in the midst of a dispute over transferring control to the community.

In early 2022, ConsenSys CEO Joseph Lubin noted that the organization is not planning to transfer complete power over the platform to the community. Instead, DAO members will be allowed to fund the development of functionality for MetaMask.

This approach does raise questions about the concept of decentralization. By not completely transferring control to the community, it can be seen as contradicting the core principle of decentralization. The community has expressed mixed feelings. Some appreciated the cautious approach, while others advocated for a more hands-off, fully decentralized model.

It is unclear what exactly determines the reluctance of ConsenSys to transfer control over MetaMask. However, the company raised $450 million from ParaFi Capital, SoftBank Vision Fund 2, and Microsoft. ConsenSys stated that they intend to spend the investments not only on forming capital for staking at the consensus level but also on the development of MetaMask.

Ultimately, the success and acceptance of this approach will depend on ConsenSys’ ability to strike a balance between decentralization and maintaining quality and security, as well as maintaining community trust and involvement.

One of the most notorious chapters in MetaMask’s history was marked by unforeseen errors that led to substantial losses for users. In December 2021, scammers distributed fake MetaMask tokens. Reportedly, the attackers inserted a code with a link to a verification icon in the description and title of the token. This trick made the scammer’s token appear as a legitimate asset.

Due to flaws in the platform’s code, the display of the verification icon also erroneously showed a textual confirmation of the smart contract’s authenticity. Once the scammers collected $1 million in tokens, they closed the protocol, and it is likely that the investments had already been laundered by that time.

In one notable instance, an investor, in an attempt to buy fake tokens quickly, sent over $340,000 in ETH to the scammers. Despite constant errors with transfers to the contract address, the victim proceeded with the transaction, as evidenced by a published screenshot of the transactions.

Later, in April 2023, MetaMask developer Taylor Monahan reported that since December 2022, an attacker had withdrawn more than 5,000 ETH and an unknown number of tokens from 11 different blockchains due to a bug. Monahan noted that no one on the team understands how the exploit works, making it impossible to determine the exact extent of the damage. The investigation revealed that the attacker targeted addresses created between 2014 and 2022. These incidents have cast a cloud of uncertainty over the platform’s reliability, prompting users to question the robustness of its underlying technology.

The period between August 2021 and February 2023 was not without its challenges when unauthorized individuals gained access to a third-party service provider used by ConsenSys customers, leading to a user data leak within the MetaMask platform. This incident impacted users who submitted a MetaMask support ticket between August 1, 2021, and February 10, 2023.

ConsenSys quickly announced that the MetaMask crypto wallet, one of its flagship products, had experienced a data breach. Importantly, the breach targeted a third-party service provider, not the application itself. ConsenSys estimated that approximately 7,000 individuals worldwide were affected by this breach.

This revelation raised concerns about the platform’s security measures and its ability to protect sensitive user information. The incident highlighted potential vulnerabilities and underscored the need for rigorous security audits in the rapidly evolving cryptocurrency landscape.

In a twist of fate, in November 2022, ConsenSys published details about its privacy policy, sparking concerns about user privacy. Allegations arose that MetaMask and ConsenSys were monitoring user activities and potentially collecting data without explicit consent.

The MetaMask browser extension wallet utilizes a node called Infura, owned by ConsenSys. Infura collects Internet Protocol (IP) addresses and wallet addresses of users who connect their MetaMask wallet to it. Not only does Infura gather information about all the wallets within a MetaMask account by linking them together, but it also collects IP addresses that can be used to locate individuals.

The ambiguity of this privacy policy led users to question the extent to which their digital activities were being tracked and analyzed. The responsibility of the company in these practices is debatable. As the crypto world becomes increasingly less anonymous, significant financial gains, Big Data, high-quality marketing, in-depth market analysis, and strategic business planning become imperative. Similarly, Google provides value to users largely through data collection about themselves, to the extent that most people do not perceive any disadvantages in it.

As mentioned earlier, MetaMask was created by the American company ConsenSys. The company was founded by Joseph Lubin in 2014 and since then has received more than $750 million in investments from various funds, including SoftBank, Microsoft, JPMorgan, Bank of America, HSBC, and many others.

On March 15, 2022, ConsenSys raised $450 million in a Series D funding round led by ParaFi Capital, reaching a valuation of $7 billion. This round featured participation from new investors, including Temasek, SoftBank Vision Fund 2, Microsoft, Anthos Capital, Sound Ventures, and C Ventures, in addition to several existing investors.

Joseph Lubin announced that the funds raised in this round would primarily be allocated to expanding MetaMask and the recently launched Infura NFT service. Additionally, a portion of the investment will be dedicated to the development and strengthening of the company’s flagship project, the ConsenSys ecosystem.

Currently, the developers are actively working on scaling solutions to address Ethereum’s scalability issues, aiming to enhance transaction speeds and reduce fees. Their commitment to security is unwavering, with ongoing efforts to make the platform more secure than ever and fortify the wallet against potential threats.

Furthermore, MetaMask is poised to expand its support beyond Ethereum, enabling users to seamlessly interact with multiple blockchain networks. This development will solidify MetaMask’s position as a universal gateway to the world of cryptocurrencies, connecting users with the broader blockchain ecosystem.

The evolution of digital wallets, as exemplified by MetaMask, has reshaped how we interact with digital assets, offering unparalleled convenience and security. This journey began with early command-line interfaces and progressed to user-friendly browser extensions, democratizing access to the decentralized world of cryptocurrencies.

MetaMask’s success is a testament to its ability to balance accessibility and security while continually evolving to meet the needs of its users. With innovations like fiat gateways and institutional solutions, MetaMask is poised to remain a cornerstone in the ever-expanding cryptocurrency ecosystem, providing individuals and institutions alike with the tools they need to navigate this exciting digital frontier.

By exploring various revenue streams, from swap fees to institutional services, MetaMask has found a way to sustain its growth and continue delivering value to its users. This ability to adapt and innovate is what sets MetaMask apart and ensures its place at the forefront of the digital wallet landscape.

This is the market sectors research conducted by Whatdahack?! and first time shared on the webinar “Web3 Tech: The Future of Sports & Entertainment” and also presented as a YouTube video “Web3 Tech: The Future of Sports & Entertainment 🏀🎬🚀 Market Research June 2024 📅 | Blockchain AI ML”.

As we stand at the cusp of a technological revolution, it’s imperative to understand how new technologies are not just redefining user interactions but are also paving the way for massive potentials in dynamically growing sectors such as Sports & Entertainment.

In today’s market sector research we uncover the potential for increased transparency, enhanced fan experiences, and novel revenue streams that Web3 technologies offer. Through our analysis, we aim to provide insights into current trends, identify challenges and opportunities, and forecast the impact of web3 technologies on the future landscape of sports and entertainment.

Since we’ve deeply reviewed the web3 technological shift in other video series you can find on this channel, go and check the description, for this time I want just to highlight the major differences between web3 and web 1.0, 2.0.

Web 1.0, known as the “Static Web” from the early 1990s to 2000s, primarily consisted of static pages for content display, lacking interactivity and limiting users to reading only. It utilized HTML for creating pages, URLs for addressing, and HTTP for server-client communication. User interaction was minimal, as there was no provision for users to engage with or contribute their own content, establishing a distinct division between content creators and consumers.

Emerging in the early 2000s and still prevalent, Web 2.0, or the “Social Web,” revolutionized the internet by emphasizing user-generated content, usability, and interoperability. It introduced dynamic web technologies like AJAX for more engaging web pages, RSS for content sharing, and Web APIs for online applications, fostering the rise of social networks, blogs, and wikis. This era significantly enhanced user interaction, transforming users from passive consumers to active creators, sharers, and collaborators, marking a significant shift in the internet’s evolution towards a more interactive and participatory platform.

Web3, arising in the 2020s, marks a leap towards a decentralized, secure internet, leveraging blockchain and AI to offer privacy and meaningful digital connections. It introduces a semantic web for smarter content organization, enhanced by spatial computing and the metaverse concept, blending digital with physical experiences in diverse applications beyond gaming. This integration not only boosts security and personalization but also revolutionizes digital interactions, providing immersive, trustless environments. This evolution represents a significant milestone in the internet’s progression, fundamentally changing how users engage with digital content.

Want to learn more about the technological shift? Check out our in-depth review on the subject from this article "Web3 As A Future Of Internet" published on Whatdahack?! website.Doing this research we could not find any finite and trusted web3 technologies taxonomy, so I decided to take this responsibility and provide the first in the market web3 tech landscape as we see it at Whatdahack?! I want to highlight that many consider web3 as a technological landscape built on blockchain solely, though we want to summon other modern technologies under the term web3 also as we see that only together they categorize and define the technological shift from the previous internet epoch. Thus we see five foundational pillars that together present the backbone of the technological construct. Each pillar addresses a different aspect of the Web3 experience, ensuring that the internet of the future is more equitable, efficient, and immersive. Let’s review these five pillars in some detail.

Personal Data Full Control (Blockchain)

Blockchain stands at the forefront of personal data control within Web3, instilling a framework where privacy is not just a privilege but a fundamental standard. This pillar empowers users with unparalleled management over their digital identities, ensuring that the control over online presence, data, and financial transactions remains firmly in their hands. It redefines the very nature of data ownership and transfer, making it a peer-to-peer exchange that is direct, transparent, and without the need for intermediaries. With blockchain, the transfer of money becomes just as fluid and user-controlled as the transfer of information, enabling secure, instantaneous financial transactions across borders, with the assurance of full ownership and reduced reliance on traditional banking systems. This level of control and autonomy not only enhances security but also ensures that users have the unfettered ability to manage and monetize their personal data and assets as they see fit in the Web3 economy.

Tokenization of Illiquid Assets (Blockchain)

In the sports and entertainment sectors, blockchain’s asset tokenization unlocks the potential of a vast array of previously illiquid assets. This includes not just physical goods but extends to the very essence of these industries: the performers and athletes themselves. For instance, an athlete might tokenize future earnings, allowing fans to invest in their career progression, while a movie franchise could tokenize and sell digital collectibles related to its cinematic universe. It also embraces non-tangible assets such as broadcasting rights or musical royalties, offering a piece of the revenue to supporters in exchange for early or enhanced financial support. This shift empowers creators and performers to harness their success potential directly, with blockchain ensuring transparent, secure, and equitable transactions, inviting fans and investors alike to engage with the sports and entertainment worlds in a novel and direct manner.

In the context of sports and entertainment, blockchain’s decentralization paradigm transforms traditional structures of authority and power. It enables the formation of decentralized autonomous organizations (DAOs) that can govern leagues, teams, or entertainment collectives, where decisions are made collectively rather than by a select few executives. This could manifest in fans voting on team decisions, plot directions in interactive media, or concert locations for musicians, effectively giving stakeholders a direct voice in the inner workings of the industry. Furthermore, decentralization through blockchain could facilitate more equitable distribution models for revenue and recognition, ensuring that the creators, athletes, and performers who are the lifeblood of sports and entertainment are rewarded fairly and transparently. It sets the stage for a collaborative and participatory future where the lines between creators, performers, and consumers are blurred, creating a more engaged and invested community.

Operational Automatization (Blockchain Smart Contracts, IoT, Computer Vision, Big Data, ML, AI, GenAI)

The sports and entertainment industries are poised to benefit greatly from Web3’s emphasis on operational automatization. For example, smart contracts on blockchain could automate ticketing processes, eliminating fraud and ensuring authenticity, while IoT devices could enhance live events through improved security and personalized fan experiences. In the realm of sports, computer vision and machine learning algorithms could analyze gameplay to provide real-time statistics and insights, improving coaching and player performance. Similarly, in entertainment, AI could tailor content distribution to viewer preferences, automate royalty payments via smart contracts, and use Big Data for predictive analytics in marketing strategies, leading to more successful launches and campaigns. GenAI might further revolutionize content creation by generating personalized media, like customizing a game or show’s difficulty level or plotlines based on user interaction, creating a highly immersive and customized experience. This blend of technologies streamlines operations, making the sports and entertainment sectors more responsive, user-friendly, and innovative..

Integrating the latest in spatial computing, the Metaverse, and BCI/BMI with the expansive potential of Web 3.0 and GenAI, we’re on the brink of a revolution in user experience across sports, entertainment, and education. These technologies allow for immersive VR experiences for fans, interactive virtual worlds for events, and thought-controlled digital interactions, enhancing engagement to unprecedented levels. Furthermore, they facilitate immersive, AI-customized sports education environments and BCI/BMI games, offering seamless integration of thought and action. This amalgamation promises a future where digital and physical experiences are not just blended but indistinguishable, offering personalized and deeply engaging ways to learn, play, and interact.

These five pillars of Web3, as outlined, offer transformative insights for the sports and entertainment industries. Blockchain empowers users with control over their data and finances, while tokenization opens investment opportunities in previously illiquid assets like athletes’ earnings or digital collectibles. Decentralization shifts power, enabling fan-driven decisions in teams or entertainment content. Automation through smart contracts and AI streamlines operations, enhancing efficiency and personalization. Lastly, spatial computing and BCI/BMI* technologies promise highly immersive experiences, revolutionizing how fans engage with sports and entertainment, ensuring a more interactive and personalized future.

*A brain–computer interface (BCI), sometimes called a brain–machine interface (BMI)

Let’s start with the most recent and overhyped use case in Sports & Entertainment, let’s start with digital collectibles or memorabilia minted on blockchain and well known as NFTs. I bet that most of you are familiar with the term NFT and its application, however I want to bring it up once again, so we are on the same page. Here is the term explanation from Wikipedia.

“A non-fungible token (NFT) is a unique digital identifier that is recorded on a blockchain and is used to certify ownership and authenticity. It cannot be copied, substituted, or subdivided. The ownership of an NFT is recorded in the blockchain and can be transferred by the owner, allowing NFTs to be sold and traded. NFTs can be created by anybody and require few or no coding skills to create. NFTs typically contain references to digital files such as artworks, photos, videos, and audio.”

“A non-fungible token (NFT) is a unique digital identifier that is recorded on a blockchain and is used to certify ownership and authenticity.

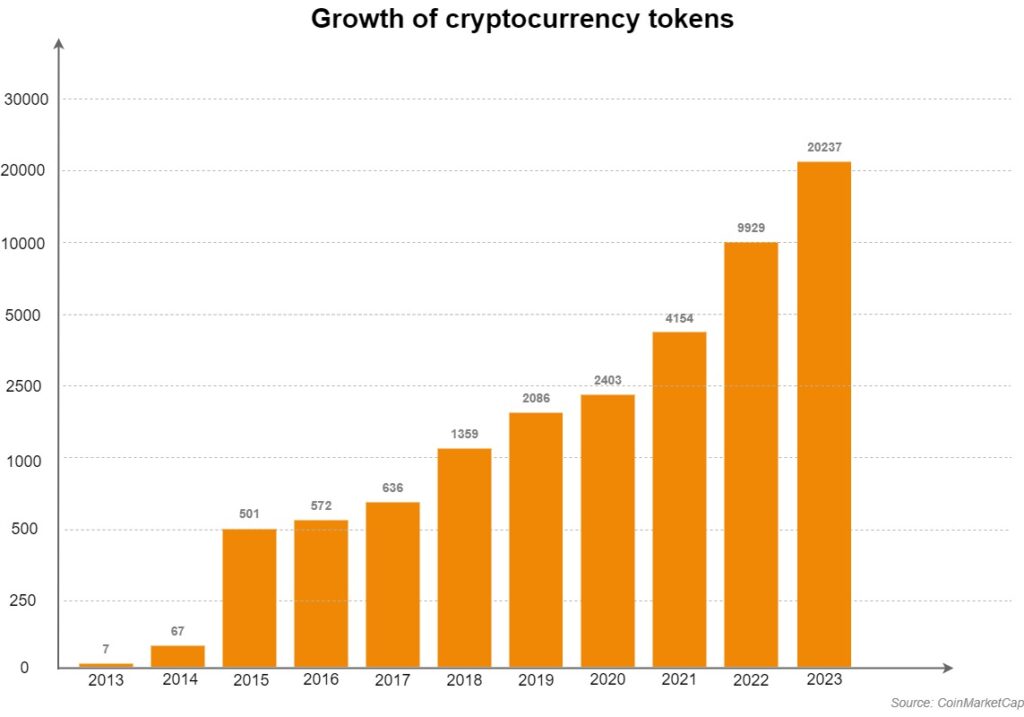

Despite the fact that the digital collectible market has been experiencing a dramatic drawdown, according to Statista it will recover with 0.19% of user penetration in 2024 to the expected 0.20% by 2028 and the projected revenue to reach US$2,378.0m in 2024.

NBA Top Shots stands out as a notable example, showcasing a successful partnership between the NBA and the FLOW blockchain. This initiative allows fans to buy and trade video highlights from NBA games, illustrating the potential of NFTs in enhancing fan engagement. However, the excitement around NFTs is not without its challenges. The current common misconception that owning an NFT grants secured access to digital art or assets, despite the ease of duplication, poses a significant hurdle. In fact, almost all NFT existing in the market can be easily downloaded and copied and thus it makes the whole idea of value transfer insecure and creates a risk of fraud and unauthorized content usage on the secondary market.

An attempt to solve the problem was taken by the authors of the Barcelona Football Club NFTs case. A well known club together with Sotheby’s auction house conducted a closed auction where the auction house provided infrastructure and resources to maintain secure access to the physical files and their transfer. However the auction house contract outlined that, beyond the authenticity guaranteed by the seller, no further representations or warranties are made about the NFTs. This includes no guarantees about copyright status, the technical aspects and condition of the NFT or associated content, the absence of digital vulnerabilities, the uniqueness of content, the functionality and compatibility of the NFT with various systems, or the correction of any defects.

Digital art has been prevalent since the inception of digital media, yet the advent of NFT technology hasn’t fully addressed pre-existing issues. However, to tackle these challenges and help our customers realize their project to the full extent, we employ advanced detection and secure storage technologies, enhancing the integrity of NFTs. Our approach leverages a fingerprint mechanism and digital signatures to assess NFT authenticity and rarity. Using deep learning, we create an ‘NFT fingerprint vector’ for each piece, featuring over 10,000 distinct numbers, compared against a vast database to establish a rarity score (0% to 100%). Computer vision aids in detecting slight differences among digital collectibles, enhancing the precision of our authenticity checks. As centralized storage presents hurdles like higher fees and data loss risks we promote decentralized storage solutions, providing better control and minimizing data loss risks. This shift towards decentralization overcomes traditional storage drawbacks, ensuring the security of digital assets in the NFT domain within a concise framework.

If your business may benefit from applying NFT technology either for audience engagement, asset value transfer or authenticity, we are to serve you as technical partners at all stages (research, discovery, development and integration). Amidst skepticism, with some art industry leaders dismissing NFTs as baseless hype, brands like Nike are pioneering the integration of these blockchain-based tokens into their products, marrying digital art with physical goods. Adidas, in collaboration with BAPE, launched a limited edition of 100 virtual sneakers in August 2023, blending digital presence with tangible value. This initiative allowed participants to trade or redeem their NFTs for an exclusive pair of sneakers, demonstrating the high value placed on such items, with bids reaching nearly $4,000.

Despite the nascent stage of generating substantial revenue, companies are exploring innovative applications of NFTs in marketing, overcoming the initial barriers associated with crypto asset acquisition, such as the necessity of browser extensions, crypto wallets, and digital transactions. Beyond marketing, the use of NFTs and NTAG 424 DNA NFC Tags introduces a novel approach to authenticating physical items, such as artworks or collectibles. This technology combination validates the authenticity and ownership of physical goods through digital verification, offering a robust solution against counterfeiting and bridging the digital-physical divide. This innovative melding of NFTs with physical authentication methods signifies a forward leap in securing and valorizing digital assets in tangible forms.

Ticketing and loyalty systems, while serving distinct primary functions, share several key features that underscore their utility in customer engagement and business operations:

Both systems facilitate a form of value exchange between the customer and the organization. Ticketing grants access to events, services, or venues in return for payment, while loyalty systems reward customers for their ongoing patronage with points or rewards that can be redeemed for discounts, products, or services.

Both systems typically involve a redemption process — whether scanning a ticket for event entry or exchanging loyalty points for rewards. This process necessitates robust infrastructure and clear rules to ensure fair and efficient transactions.

Today, I aim to explore the integration of blockchain technology with ticketing and loyalty systems, and discuss why it may not be the comprehensive solution many anticipate.

Blockchain in ticketing can address issues such as counterfeit tickets and scalping, and provide a more secure and transparent system. However, attempts by major brands have yielded mixed results. For instance, consider Ticketmaster’s acquisition of a blockchain ticketing solution called UPGRADED. Despite initial excitement, progress has stalled, with the startup’s website now defunct. Similarly, ventures like FanDragon Technologies have dissipated, casting doubt on the viability of blockchain in ticketing.

Regarding ticketing and loyalty systems, it is crucial to highlight two blockchain applications designed to enhance existing experiences and create new ones for event organizers and attendees: NFTs and their derivative, POAPs.

POAP NFTs, which are still in the early stages of development, are not widely recognized. A POAP—Proof of Attendance Protocol token—primarily verifies event attendance or marks a significant life moment as a digital collectible. The concept of digitally bookmarking life moments may seem peculiar, but let’s investigate its validity and whether it is merely another speculative venture by the cryptocurrency community.

Currently, POAPs provide a novel way to engage with NFTs. They do not possess the same monetary value as traditional NFTs traded on marketplaces. POAPs offer unique advantages that differentiate them from other engagement methods:

mmutable Proof of Attendance: POAPs offer reliable, tamper-proof records of attendance, recorded on a blockchain, unlike traditional methods like surveys or check-ins, which can be prone to manipulation or human error. Additionally, a POAP collection can serve as a blockchain-style resume.

Tangible Digital Mementos: POAPs are digital collectibles that attendees can keep as lasting mementos of their participation. Unlike transient engagement methods such as social media posts or email newsletters, POAPs provide enduring value as commemorative tokens that attendees can treasure and display in their digital wallets. For event organizers, this facilitates better community engagement by minting POAPs to commemorate significant moments or achievements.

Exclusive Access and Rewards: As a form of NFT, functioning as a smart contract or unique identifier, POAPs can grant holders access to exclusive content, benefits, or experiences. Issuing special access POAPs can incentivize engagement and reward participation in a meaningful way. For instance, in some communities, possessing more POAPs can grant enhanced privileges, such as increased voting power in polls or DAO project proposals.

In summary, POAPs provide a unique blend of immutable proof of attendance, tangible digital mementos, and exclusive access and rewards. These elements make POAPs an invaluable engagement tool for event organizers, enhancing the attendee experience and fostering memorable events.

However, NFT tickets still face challenges such as reselling, privacy concerns, and the cost of on-chain operations. While blockchain offers promising solutions across various domains, its application in ticketing presents significant hurdles. It is prudent to approach this technology with caution, considering both the benefits and the inherent complexities.

The programmability of NFT tickets enables more sophisticated interactions by various stakeholders, including owners, sellers, creators, and promoters. These features have significant implications for the industry, affecting aspects such as maximum price settings, resale revenue, digital collectibles, and loyalty rewards.

A maximum ticket price can be set, even during resales, which greatly reduces the incentive to buy tickets at face value and resell them at inflated prices on secondary markets. This mitigates the issue of tickets being sold out from the primary seller and only available at exorbitant prices from secondary intermediaries.

Artists, athletes, and event creators can now receive royalties from ticket resales programmed into the smart contract, ensuring they benefit from each transaction. The NFT ticket can also become an aesthetically pleasing collectible, akin to physical tickets from past events.

Finally, a rewards program for loyal fans can be implemented more effectively with blockchain, facilitating seamless collaboration between parties. This contrasts with previous models where companies maintained their data in isolation, hindering cross-organization collaboration.

While blockchain presents potential opportunities to innovate and address longstanding issues within the event industry, notable collaborations and acquisitions by major players involving NFT-ticket startups have not yielded any notable successes since 2022. This observation suggests that mere adoption of raw blockchain technology is insufficient. Instead, a seamless user experience and robust infrastructure are essential requirements that are currently lacking. These elements must be developed and integrated comprehensively for NFT-ticketing and web3-based loyalty systems to achieve widespread acceptance and use by businesses and their customers.Remember the days when websites were mere collections of pixelated GIFs and clip art text? If you don’t, a stroll down memory lane through Geocities archives might jog your memory. GeoCities, the pioneering web hosting service active from 1994 to 2009, offered users the freedom to create and publish their websites, marking the early days of online creativity.

Fast forward to today, where we find ourselves on the brink of a new era in user experience design, one driven by XR (Extended Reality) technology and UX 3.0 principles. But what exactly is XR UX 3.0, and how is it reshaping the landscape of sports engagement?

The transition from traditional 2D interfaces to immersive 3D experiences marks a significant leap in user engagement and interaction. While 3D representation has been lauded for its effectiveness in various fields like education and entertainment, its integration into web experiences has been a gradual process.

The introduction of WebGL technology in 2009 laid the foundation for 3D experiences online, yet widespread adoption took time as browsers gradually incorporated support for the WebGL API. Despite initial hurdles, the potential for interactive 3D websites began to emerge, offering users a glimpse into the future of online interaction.

UX 3.0, also known as Web3 UX, represents the next frontier in user experience design, leveraging advanced technologies like AI, AR, VR, and IoT to create seamless digital experiences. By bridging the gap between the digital and physical worlds, UX 3.0 aims to provide users with personalized, intuitive, and immersive interactions.

Key advancements in technology, including blockchain, AI, and the growth of AR/VR, have paved the way for the emergence of UX 3.0. These innovations have not only expanded the possibilities for user engagement but have also redefined how we perceive and interact with digital content.

In the realm of sports, XR technology is revolutionizing the fan experience, offering immersive viewing opportunities that transcend traditional boundaries. Virtual Reality (VR) allows fans to step into the shoes of their favorite athletes, providing unprecedented access to live events from the comfort of their homes.

Augmented Reality (AR) and Mixed Reality (MR) enhance the viewing experience further, providing real-time stats and analysis that enrich the overall experience. Whether watching from home or in the stadium, fans are treated to a personalized and interactive journey through the world of sports.

Digital twins, virtual replicas of physical objects or environments, are reshaping the way sports organizations plan and engage with fans. By creating virtual models of stadiums and arenas, teams can offer fans a unique and immersive viewing experience, complete with interactive elements and real-time statistics.

These digital twins not only enhance fan engagement but also offer valuable insights for stadium planning and management. From optimizing seating arrangements to improving crowd flow, digital twins are becoming indispensable tools for sports organizations looking to elevate the fan experience.

As we look ahead to the future of sports engagement, one thing is clear: XR UX 3.0 is here to stay. By embracing technologies like XR, digital twins, and IoT, sports organizations can create truly immersive and personalized experiences for fans around the world.

From virtual viewing parties to interactive merchandise stores, the possibilities are endless. As the industry continues to evolve, the integration of XR technology will be key to staying ahead of the curve and delivering unforgettable experiences to fans everywhere.

In conclusion, the convergence of XR technology and UX 3.0 principles is ushering in a new era of fan engagement in sports. By leveraging the power of immersive experiences and digital innovation, sports organizations can create lasting connections with fans and unlock new revenue streams in the process. As we embrace the future of sports engagement, one thing is certain: the best is yet to come.

In the burgeoning landscape of financial paradigms and fan engagement strategies, a novel concept has emerged: talent tokenization. This innovative approach, akin to personal Initial Coin Offerings (ICOs), transcends traditional fundraising methods by encapsulating an individual’s potential future earnings or talents into digital tokens. Such tokens afford investors the opportunity to directly support promising talents, thereby establishing a symbiotic relationship between backers and beneficiaries.

Rooted in the essence of democratized ownership, talent tokenization represents a departure from conventional project-specific funding mechanisms, epitomized by personal ICOs. Rather than tethering investment prospects to singular ventures, talent tokenization broadens the scope to encompass an individual’s overarching career trajectory, thereby fostering a more holistic investment landscape.

Within the realm of sports, the tokenization of club ownership into securities has emerged as a transformative force, offering fans a stake in the financial prosperity of their beloved teams. Through this paradigm shift, supporters transcend their traditional role as mere enthusiasts, assuming the mantle of stakeholders with vested interests in their clubs’ economic success. Moreover, club tokenization injects much-needed liquidity into the sports sector, thereby augmenting financial stability and providing clubs with innovative avenues for capital procurement.

However, the proliferation of talent and club tokenization is not devoid of challenges. Chief among these are the intricacies of navigating the evolving legal framework surrounding tokenization, the specter of market volatility, and the inherent risks associated with investing in the mercurial trajectories of individual careers. Despite these obstacles, success stories such as that of Spencer Dinwiddie, who tokenized his NBA contract, underscore the transformative potential of talent tokenization in fostering financial autonomy and deepening fan engagement within the sports arena.

In tandem with talent tokenization, the advent of club tokenization heralds a new era of fan-centric engagement strategies within the sports and entertainment industries. Platforms such as Socios.com have pioneered the concept of Fan Tokens, which afford supporters exclusive benefits and voting rights, thereby fostering a sense of community and empowerment among fans. Moreover, club tokenization represents a convergence of decentralized finance (DeFi) and sports, offering an alternative to the limitations inherent in traditional financial models.

Notably, the implications of club tokenization extend beyond mere financial transactions, encompassing broader sociocultural ramifications. By bridging the chasm between fans and stakeholders, club tokenization engenders a more profound sense of belonging and investment among supporters, thereby redefining the dynamics of fan-club relationships.

In conclusion, talent and club tokenization epitomize a paradigm shift in the realms of finance and fan engagement. Rooted in principles of democratized ownership and decentralized finance, these phenomena offer promising avenues for supporting emerging talents and fostering deeper connections between fans and their respective clubs. As the journey into tokenization unfolds, it behooves stakeholders to navigate the attendant challenges and capitalize on the transformative potential of these novel financial instruments.

Democratization of Investment: Unlike an IPO, which often requires significant capital, tokenization allows fans to invest smaller amounts, making club investments more accessible to the general public.

Enhanced Liquidity: Tokens can be traded on various exchanges, offering greater liquidity than traditional shares, which are often bound by more restrictive trading regulations.

Flexibility: The terms of fan tokens can be customized, offering various benefits that are not usually part of traditional stock offerings, such as exclusive experiences or merchandise.

The future is quite an intriguing thing. Today’s technologies have already made the fantasies of “ancient” philosophers real, bringing them further than they could ever imagine. The metaverse is one such idea or phenomena. Neal Stephenson introduced the word “Metaverse” in his science-fiction novel “Snow Crash” 30 years ago (1992) to describe a world that people use to escape a dystopian reality, creating digital avatars of themselves and exploring the online world. This is exactly what is happening right now, and this concept has already been taken even further.

The fixed-line internet of the 1990s inspired many of us to purchase a personal computer, and the mobile internet allowed almost everyone to stay continuously connected. The metaverse goes further by placing everyone inside an “embodied,” “virtual,” or “3D” version of the internet on a nearly unending basis. It means we will constantly be “within” the internet, rather than merely having access to it, and within the billions of interconnected computers around us, rather than occasionally reaching for them, and alongside all other users in real-time.

Follow along to reach an understanding of what the metaverse is and where to find it, how big companies may find a new approach to their business, the evolution of video games, the opportunities to invest in new technologies, the future of the internet, and what is a reality nowadays.

While digging into this theme, one may perceive the metaverse as virtual reality. This is a common issue. In truth, virtual reality is merely a way to experience the metaverse. VR devices (like headsets) and VR games come in handy to explore the metaverse, though they aren’t the metaverse itself.

Sometimes the metaverse is described as a user-generated virtual world or virtual world platform, or an online multiplayer video game. This is also not a fully correct notion. We will play games in the metaverse, but those games in the metaverse are not the metaverse itself.

The metaverse is a network of interconnected experiences and applications, devices and products, tools and infrastructure that will surely change us.

You might be a bit confused:

“Alright then. Do you mean the metaverse is everything and nothing, and it’s too early to dive into?”

Don’t worry, we will show examples and explain in detail how it currently looks and where it is expected to reach in the near future. For now, we want you to understand the metaverse as a virtual space, the user of which is not just watching the content but is an actual part of this content, or inside the content, and can be or do anything they want.

…the metaverse as a virtual space, the user of which is not just watching the content but is an actual part of this content, or inside the content, and can be or do anything they want.

One of the Winklevoss brothers, Cameron, called it “Recreation of real-world online.” And the Meta leader, Mark Zuckerberg, sees the metaverse as “a virtual environment where you can be present with people in digital spaces, an embodied Internet that you’re inside of rather than just looking at.” Zuckerberg believes “that this is going to be the successor to the mobile Internet.”

Now for some examples. Let’s dive into the legendary Fortnite from the Epic Games company with over 250 million players, which has already grown from just a funny game-shooter into something phenomenal. Fortnite is developing the ability to offer its users beyond-gaming opportunities. For example, in April 2020, Travis Scott played the game online and brought together 12 million “visitors” all at once! (Video Of The Concert) That’s a safe and impressive way of holding such a huge event with fans being able to join and be in the center of the party from anywhere on the planet . Moreover, a whole sub-economy on Fortnite has emerged where “players” can build (and monetize) their own content. This approach shows the longer-term vision for the game. Its Creative Director, Donald Mustard says: “Fortnite isn’t the metaverse, but nothing is closer to the metaverse today in spirit and it is clear how the “game” might eventually underpin one.”

To sum up, Fortnite combines an online shooter and Battle Royale game, a virtual space to connect in real-time with other users to attend concerts or watch movies, a platform to make money creating own “rooms,” unique items or moves to share with other “players,” and last but not least,, Fortnite brings together multiple closed platforms. Your Counter-Strike gun skin, for example, could also be used to decorate a gun in Fortnite, and it’s even one of the few places where the intellectual properties of Marvel and DC intersect.